Flow Review June 15, 2024: How we used Unusual Whales to know when Roaring Kitty exited his GameStop, $GME calls

In today’s issue, we’re going to go over how to track large positions using Gamestop, $GME, and Roaring Kitty’s famous 120,000 contract position in the $GME $20C 6/21/2024 contract. We’ll also speculate lightly on whether or not contracts were exercised.

We’ve written about the current $GME saga a couple of times, and were the first to start directly tracking Roaring Kitty’s position in the $20 call expiring on June 21st, 2024. Since then, all eyes have been on the position, and on Reddit, looking for signs of an update from Roaring Kitty on his positions.

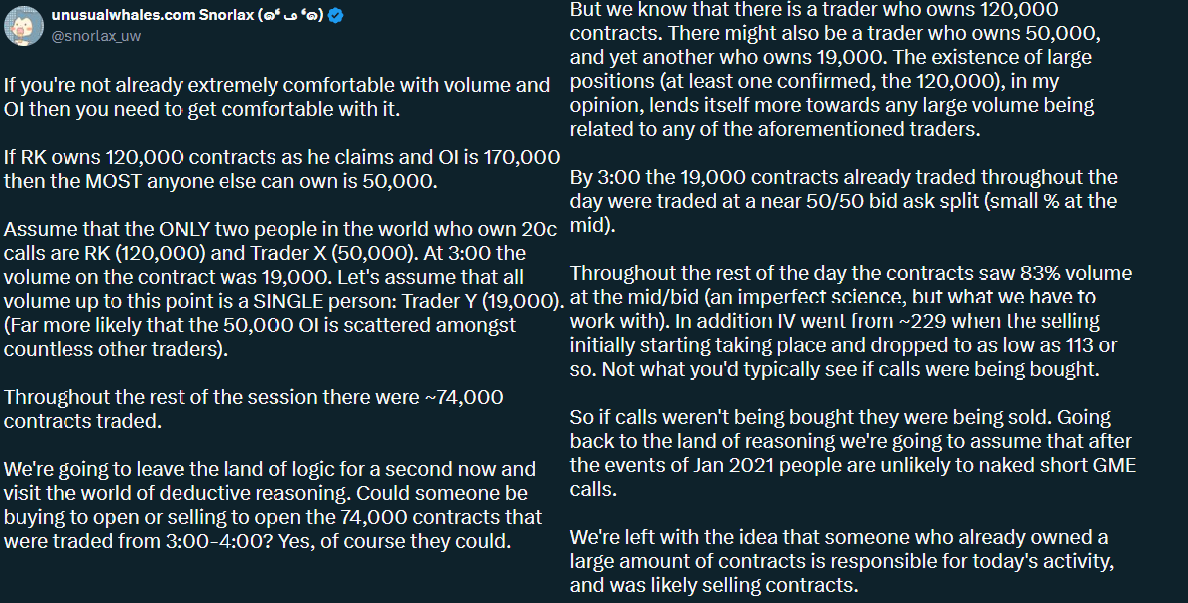

We first noted significant bid-side transactions on June 12th, 2024. On the morning of the 12th, we saw 2,000+ contracts transact at the bid, but the real size came later in the day. During the hour leading into market close on June 12th, we saw a series of sizable bid-side activity.

Three sets of orders were particularly interesting, with the first coming in between 3:30 and 3:40 EST with 6,479 contracts transacting at the bid, and another 8,915 with mid fills. Ten minutes later, another 15,672 contracts transacted at the bid, followed by the largest volume of the day, with 23,034 contracts transacted at the bid. The total volume for the day on June 12th came in at 93,266, with 64% of that volume transacting at the bid.

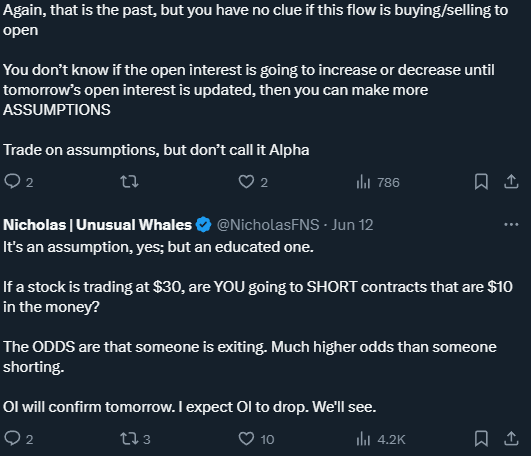

Given that this marked the largest volume on the contract since the Roaring Kitty position was tracked and disclosed, it led to many disagreements on Twitter/X. Some speculated it wasn’t him.

But the data suggested that it was indeed Roaring Kitty trimming his position.

On the morning of June 13th, the Open Interest of the $20C 6/21/2024 dropped considerably, by 58,145 contracts. Considering Roaring Kitty was the only individual known to have a position large enough to trim that many contracts, logic pointed to a positional exit.

Now that the OI had dropped below 120,000 contracts, we could deduce that, since Roaring Kitty owned 120,000 contracts, he did indeed close some of his position. On June 13th, the $GME $20C 6/21/2024 saw more high volume activity, when 48,787 contracts transacted intraday, with 56% coming in at the bid – given the sizing, and the known large position, this was also most likely Roaring Kitty trimming more contracts.

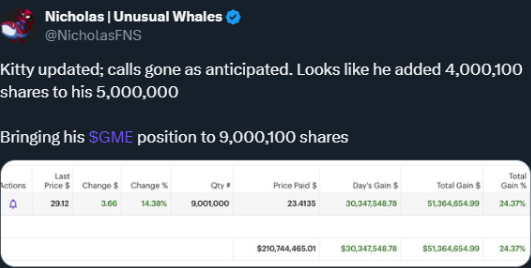

It wasn’t until after Market Close on 6/13 that we got a position update from Roaring Kitty.

On the night of June 13th, Roaring Kitty posted an update of his $GME position to r/SuperStonk.

As the data suggested, Roaring Kitty had sold all 120,000 of his $20C 6/21/2024 contracts, but he had another update. He had added 4,001,000 shares of $GME. This led to speculation on whether or not he exercised some of his contracts. Well, let’s break that down:

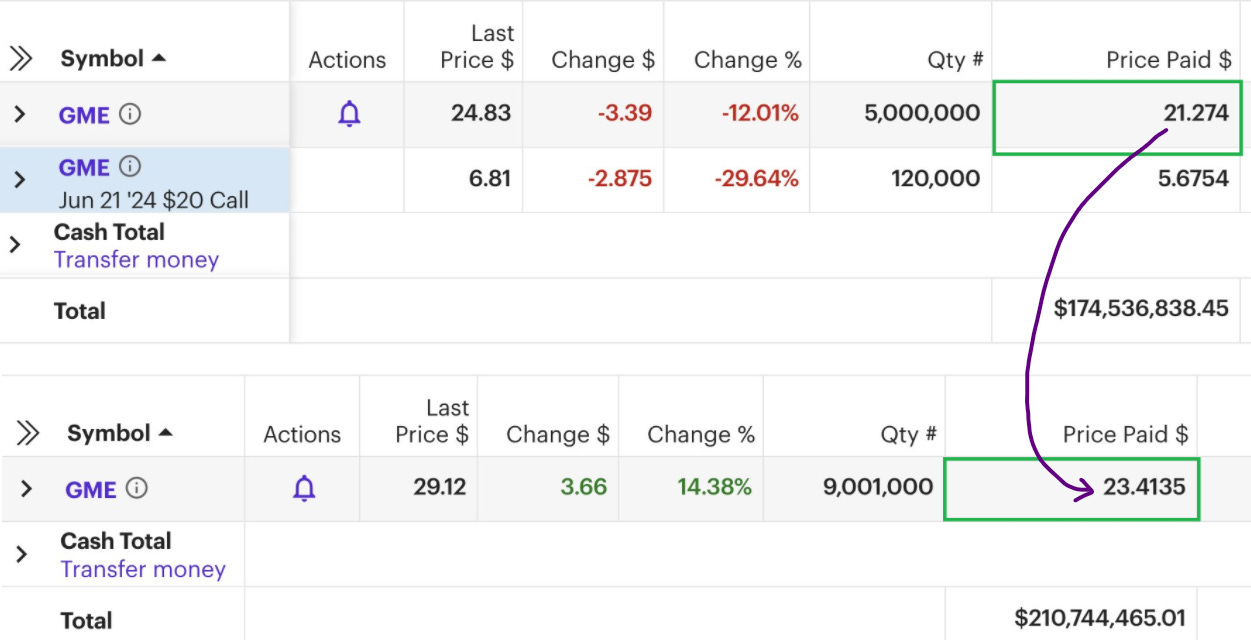

The top half of the image is from RoaringKitty’s prior position update. His cost basis on 5,000,000 shares of $GME sat at $21.274 per share. In the updated version, we see that this average cost had risen to $23.4135.

Given the cost basis of his contracts, it's not entirely clear whether or not he exercised, but certainly possible (assuming E*Trade includes the cost of contracts in that average).

Since he had contracts of the $20C, at a cost basis of $5.67 per contract, it’s certainly possible that the average share price of his newly acquired 4,001,000 shares came from exercising some of his contracts, as he’d pay $20 per share, PLUS the cost of the contracts, ($567 per every 100 shares).

While it’s possible he exercised some of his contracts, we do know that the vast majority of his 120,000 contracts were sold to close, and given the movement RoaringKitty seems to represent, it’s unlikely that he exercised; more likely he sold all of his contracts, and bought shares at market.

Here is the full article as a Youtube link:

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.