Flow Review $COF August, 2024: Following a $COF trader using Historical Flow

In this flow review, we’re going to cover both how to track unusual flow, and how to spot when contracts exercise using the Unusual Whales options flow and Historical options flow.

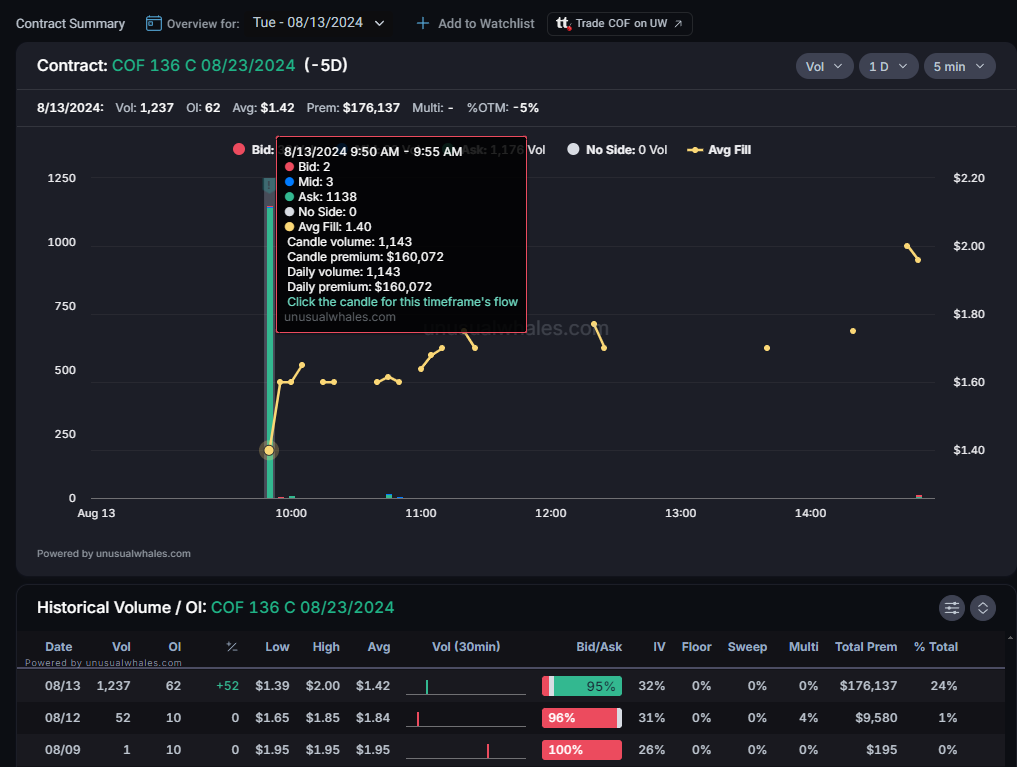

The unusual options activity we’ll cover today came from a trader speculating on upside movement in Capital One Financial Corp., ticker $COF. On Tuesday, August 13th, over 1,100 contracts of the $136 call contract expiring on August 23rd hit the tape. The bid/ask spread at the time of fill was $1.25 - $1.40, and the average fill was right at the ask price of $1.40. Given the lack of open interest, we know this was a newly opened position, and given the nature of those at-ask fills, it’s likely that these contracts were bought to open.

When the orders hit the tape, $COF traded at $132.86 per share, placing these $136 call contracts around 2% out of the money. By Monday, August 19th, $COF had rallied dramatically, reaching highs of $143.01 per share.

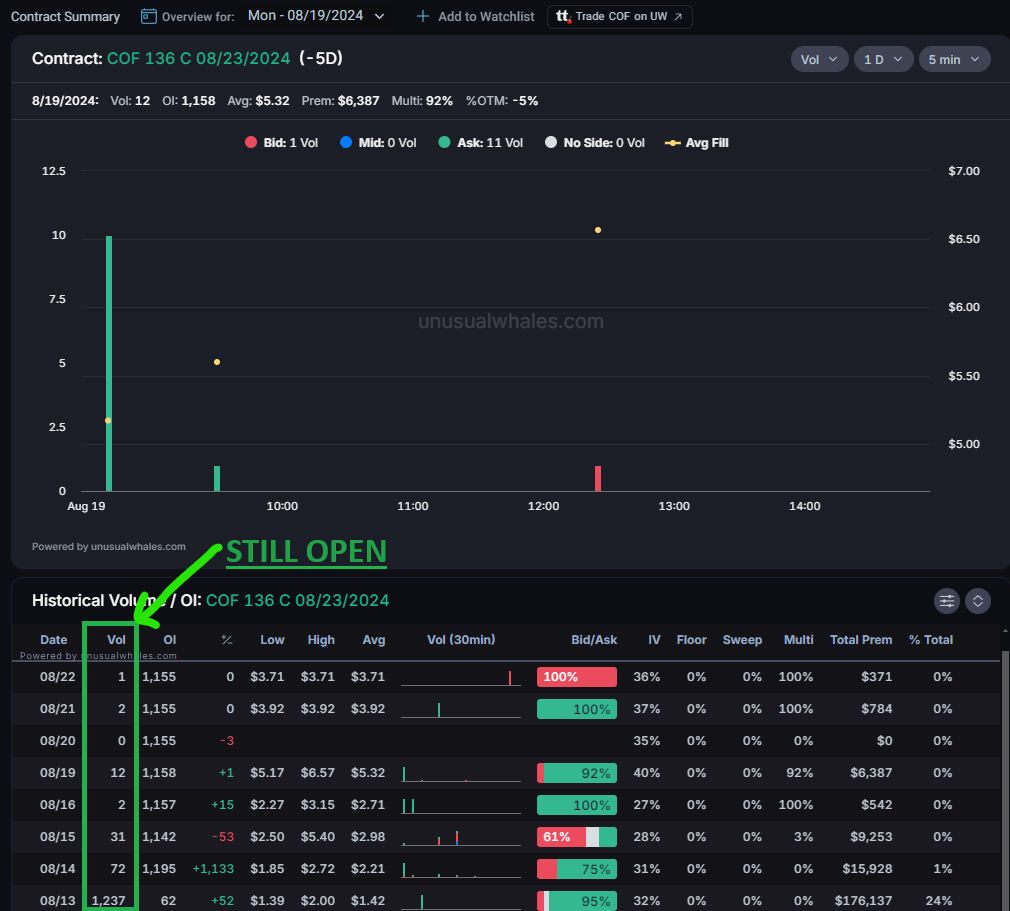

While $COF rallied, we can tell the trader never took profit on the position. When the contracts reached a value of $5.40 per contract on August 15th, a 285% increase, no volume transacted: the position remained open. After a pullback on August 16th, driving the value of the contract back down to $2.27? The position remained open. On August 19th, as $COF cracked $143 per share, the value of the $136C hit a high of $6.57 per contract; a 369% gain, the trader still didn’t close their position.

On the day of expiration, August 23rd, the share price of Capital One had dropped to lows of $139.51 before a bounce back toward $143, which dropped the value of the $136 call contract significantly. The trader remained in the position, and by market close on Friday 8/23, no volume had transacted to indicate a positional exit. The contracts, however, remained in the money, as $COF closed the session well above $136 per share.

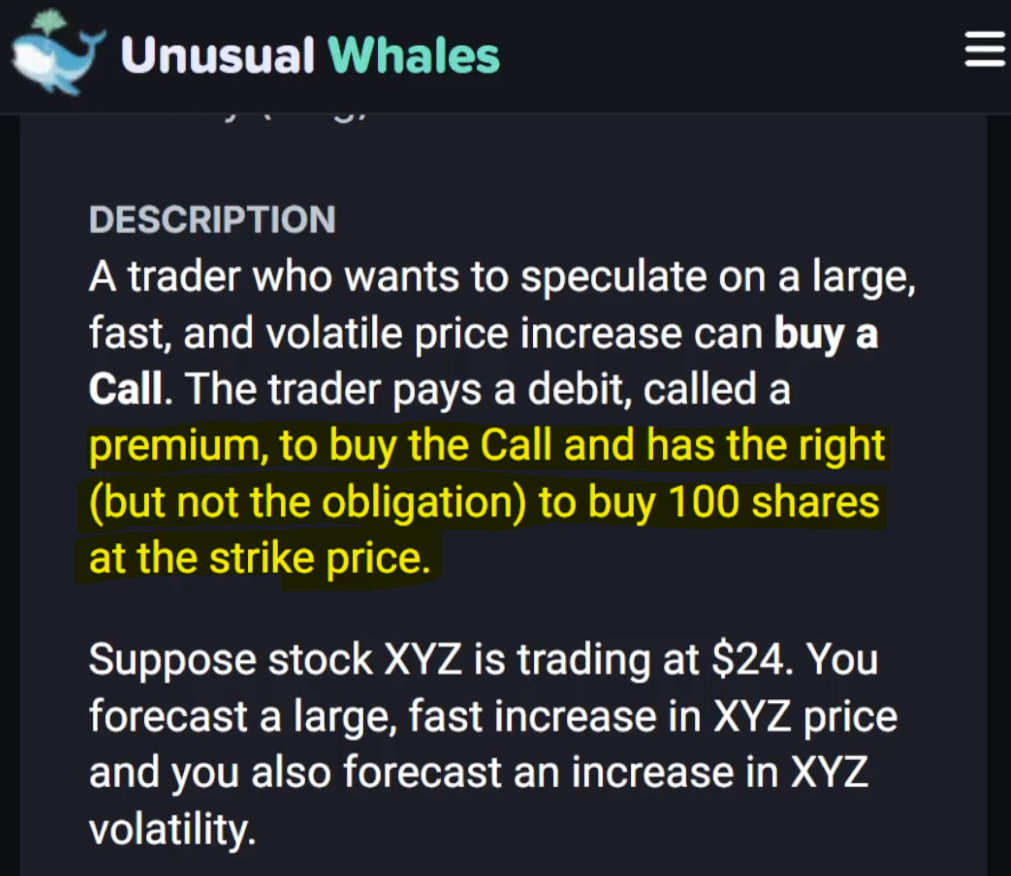

So this bears the question: What happens if contracts expire in the money? If you recall from our prior educational pieces, buying a long call contract gives you the right, though not the obligation, to buy shares at that strike price should the contract go in the money.

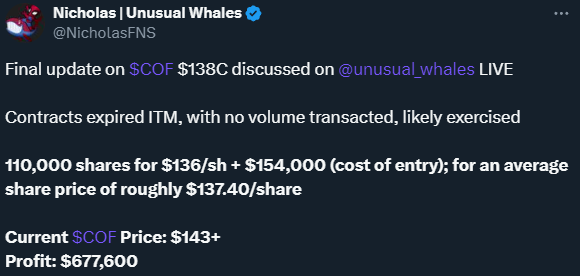

Looking through the history of this option contract’s volume profile, this indeed appears to be what this $COF trader has done. The contracts expired in the money, with no volume transacted to indicate an exit, meaning the trader most likely saw those calls exercised to obtain shares. So let’s do a super quick breakdown of what this trader ended up with when $COF closed at around $143 per share on Friday, August 23rd.

Each option contract represents 100 shares of the underlying. This trader opened 1,100 contracts at $1.40 each, for a total premium paid of $154,000. By exercising the contracts, the trader acquired 111,000 shares at $136 per share; however, there’s the additional cost they paid for the option position. So, 110,000 shares at $136 + the $154,000 position cost, brings us to a total cost of $15,114,000. If we divide that cost again by the 110,000 shares, we see that the trader paid $137.40 per share.

With $COF at $143, this means the trader has profited around $677,600 on the trade. It does cause a bit of an eyebrow raise, however, because the trader did make more by exercising the shares than they’d have made by selling the position at the contract high of $6.57. However, one does wonder, if the trader intended to exercise the contracts at expiration, why the trader didn’t just buy shares outright while $COF traded at $132.86 per share, rather than open the option position.

It just goes to show that we can never really know for sure what a trader is thinking when their position hits the tape; we can only speculate using the data, and make our own educated decisions!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.