Flow Review February 12, 2025: Unusual Activity on $KWEB and a Follow Up Trade

In this issue, we’re going to go over unusual high volume options activity that occurred in the third week of January and just recently closed out for a handsome gain on their position. This tracked trade will also help outline how to track volume and open interest over time, as well as a crystal clear entry and exit! Then we’ll demonstrate how a similar position opened around the same time as the exit on the first, and track that trade as well.

Two $KWEB traders make millions on call contracts

The first contract we’ll be covering today is the $32 call contract expiring on September 19th, 2025, for Kraneshares CSI China Internet ETF, $KWEB.

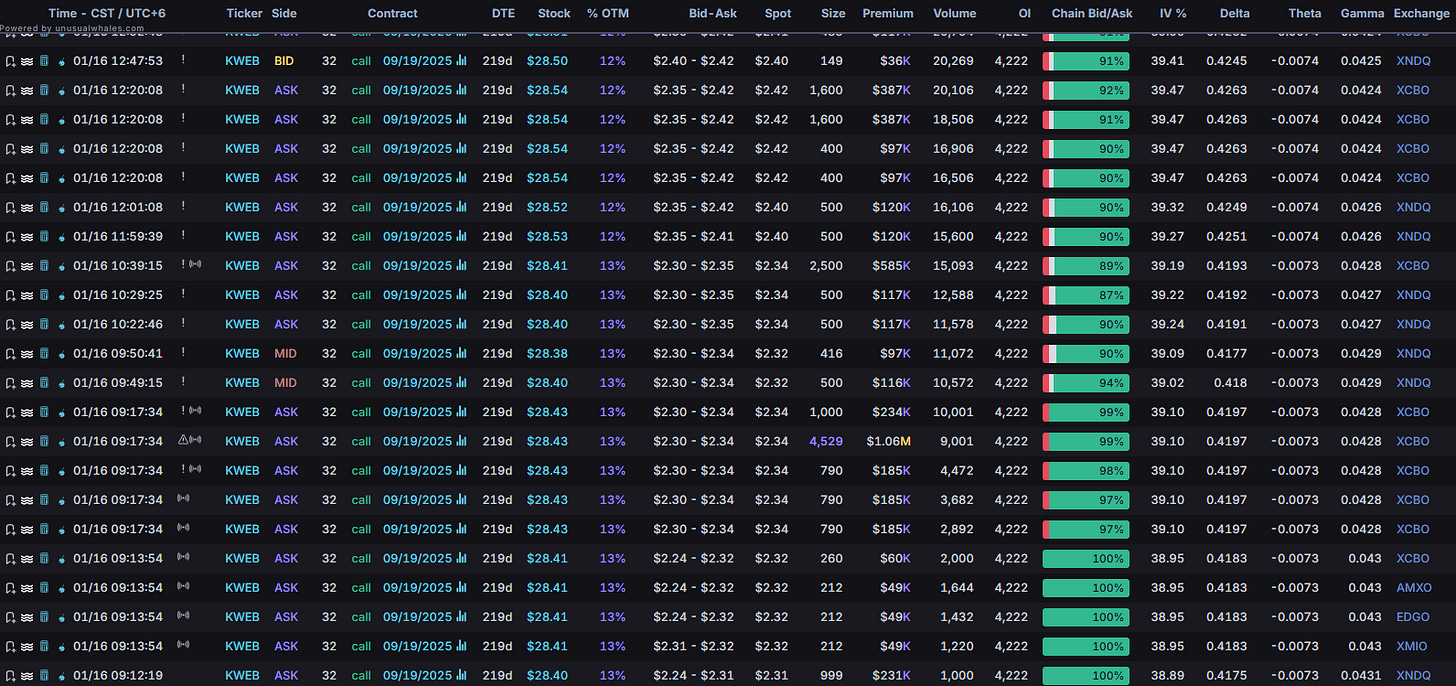

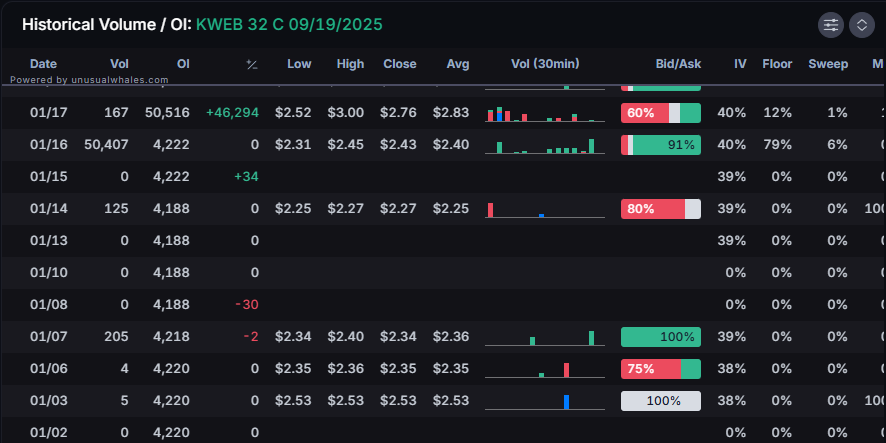

On the morning of January 16th, Unusual Whales team member snorlax_uw noted rapid and sizeable transactions hitting the $32C 9/19/2025 at the ask of $2.34. Several more taps on the contract hit the tape at $2.34, $2.42, and $2.44 per contract. Over the course of the day, 50,000+ volume transacted at the ask for an average fill price of $2.40 per contract for a total premium of roughly $12 million.

At the time of these transactions, there was only 4,222 open interest, which means that the very first order of the day at 7,900 contracts alone indicated a newly opened position (transaction volume > open interest). Meanwhile, the $KWEB stock price traded around $28.55 to $29 per share.

You may recall a previous article we wrote about traders capitalizing on the Chinese stock frenzy at the end of 2024. It appears here that some of that hype hasn’t cooled off yet, as $KWEB continued to climb in the coming days.

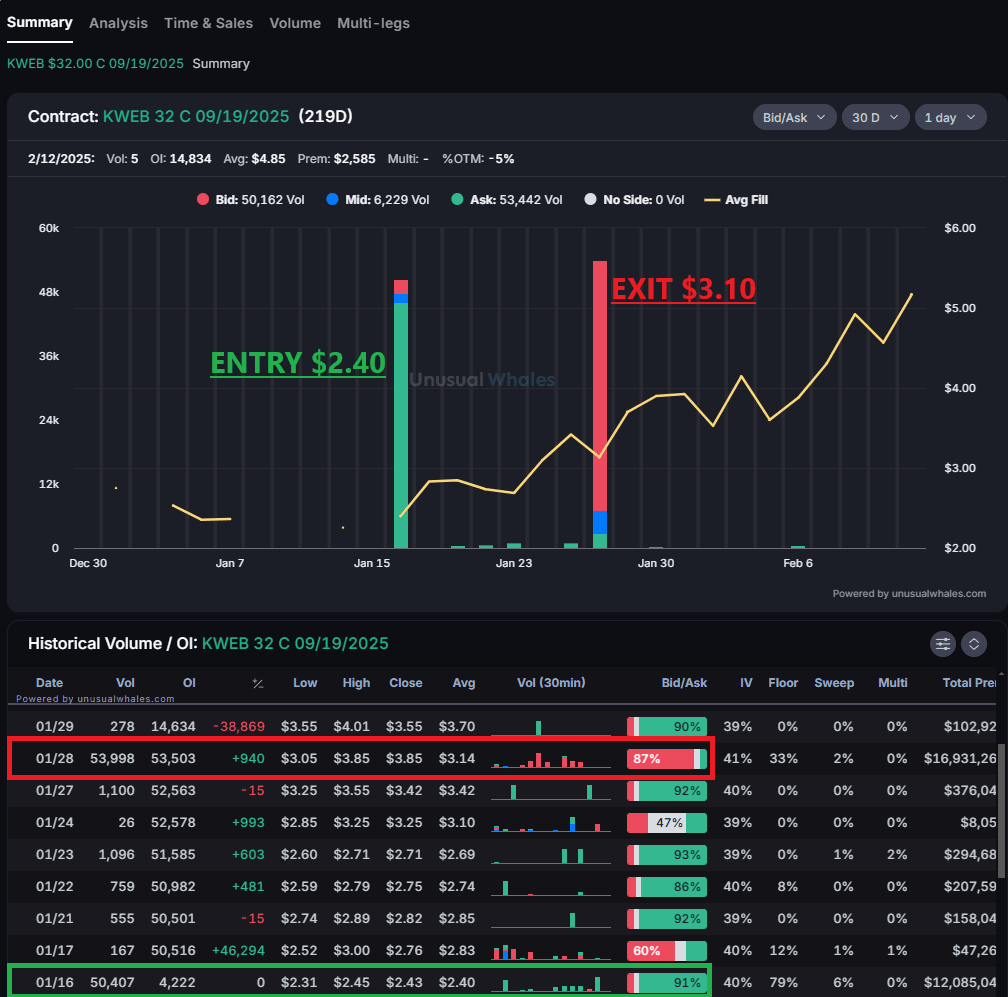

The trader maintained their position up until January 28th. By then, $KWEB traded as high as $31.10 per share, and in the afternoon of the 28th when $KWEB traded at $30.69, this trader finally pulled the trigger on their profits. From an entry price of $2.40 per contract, the trader closed this position at $3.10 each, a 30% gain on their $12 million entry, for a profit of $3.5 million. The Volume Profile of the contract shows about as clear of an example of “entry” to “exit” that you can find.

Now, you may notice on the far right side of that chart that $KWEB’s trajectory didn’t stop. While this trader didn’t catch the FULL move to current day, on the day this position exited, another position on a separate $KWEB contract hit the tape with size.

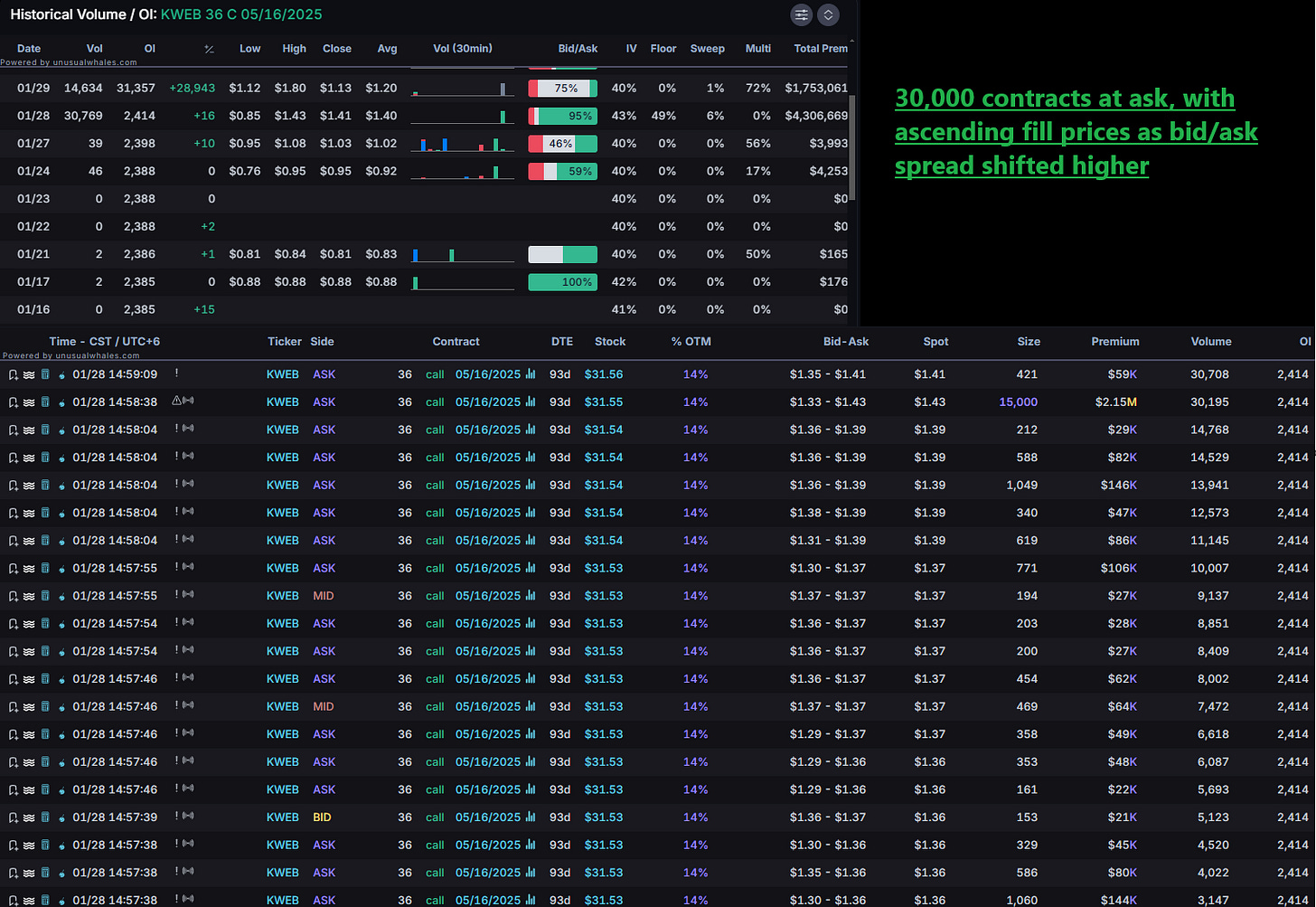

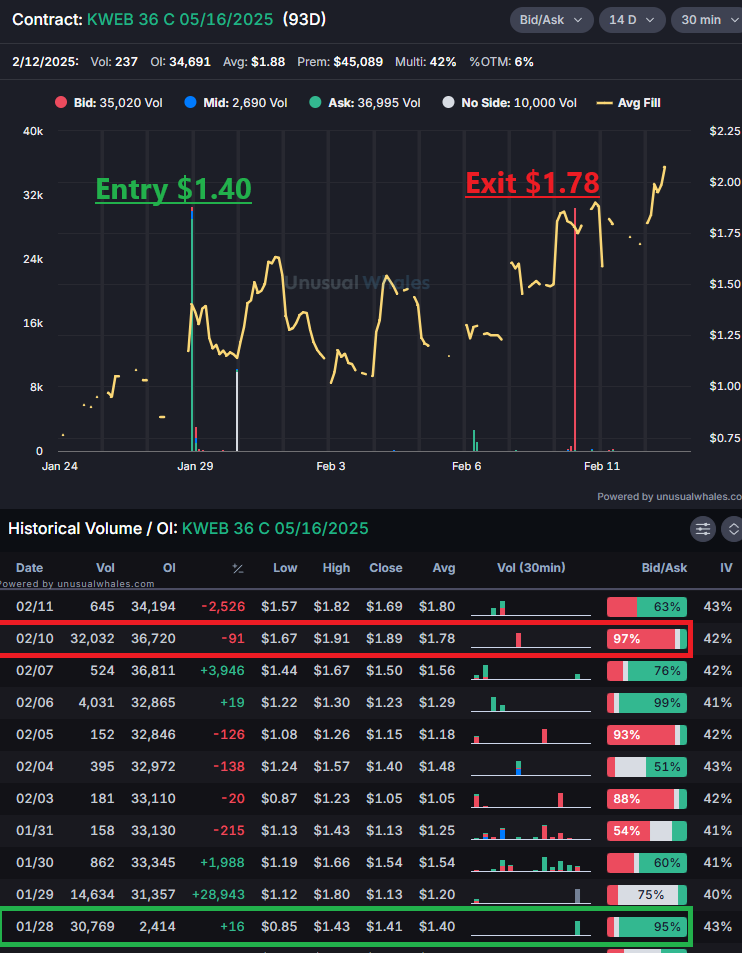

Around the same time the $32C position closed, the $KWEB $36 call contract expiring in May 2025 hit the tape in similar sizing. 30,000 contracts transacted at the ask with ascending fills as the bid-ask spread rose, for an average fill of $1.40 and a total premium of $4.2 million. The $KWEB stock price traded around $31.53 at the time of filling.

Once again, the trajectory of $KWEB stock continued up and to the right. From January 28th to February 10th, shares rose from $31.55 to $33.62 per share. The $36C 5/16/2025 had a handsome spike in value alongside the share price, reaching a high of $1.91 per contract on February 10th. The trader, however, nabbed their profits a bit lower than that at $1.78. This marked a 27% gain on the trade, for a profit of $1.14 million.

You may notice that on 2/11, the open interest didn’t drop by the full 30,000. This doesn’t indicate the trader did not exit; it’s more likely that the contracts changed hands rather than closing out entirely. All indications, despite no drop in OI, point to a profit take on the position opened on 1/28.

There’s no guarantee that this is the same trader. However, given the similar sizing, the timing, and nearly identical point at which profit was taken, it seems possible!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.