Flow Review November 2024: Trading around Crypto stock $CLSK around Trump's Election

In this review, we’re going to cover unusual options activity noted in mid-October. This specific trader spent around $100,000 on CleanSpark, Inc. $CLSK, and held their position until it reached profitability to the tune of millions.

How an options trader made hundreds of thousands on Bitcoin miner, CleanSpark $CLSK

As we’ve all seen, Bitcoin has been on an absolute tear recently. Some have been speculating this move since the Bitcoin halving earlier this year; some accredit the recent rally to President-elect Donald Trump’s election victory. Indeed, Trump’s team has outlined very pro-Crypto policies moving forward, taking a seemingly hard stance on expanded crypto acceptance in the United States.

Since the election, Bitcoin has reached new high after new high; by November 5th, $BTC hit an all time high of $75,000. By November 9th, a new high was set at $77,000. From there, the proverbial snowball really picked up the pace, with $BTC hitting $85,000 on November 12th, then on November 13th, it broke through the $90,000 barrier to hit yet another high of $93,000.

Before all this, though, the options market for Bitcoin miners saw some interesting action. The position we’ll look at today started building back on October 16th.

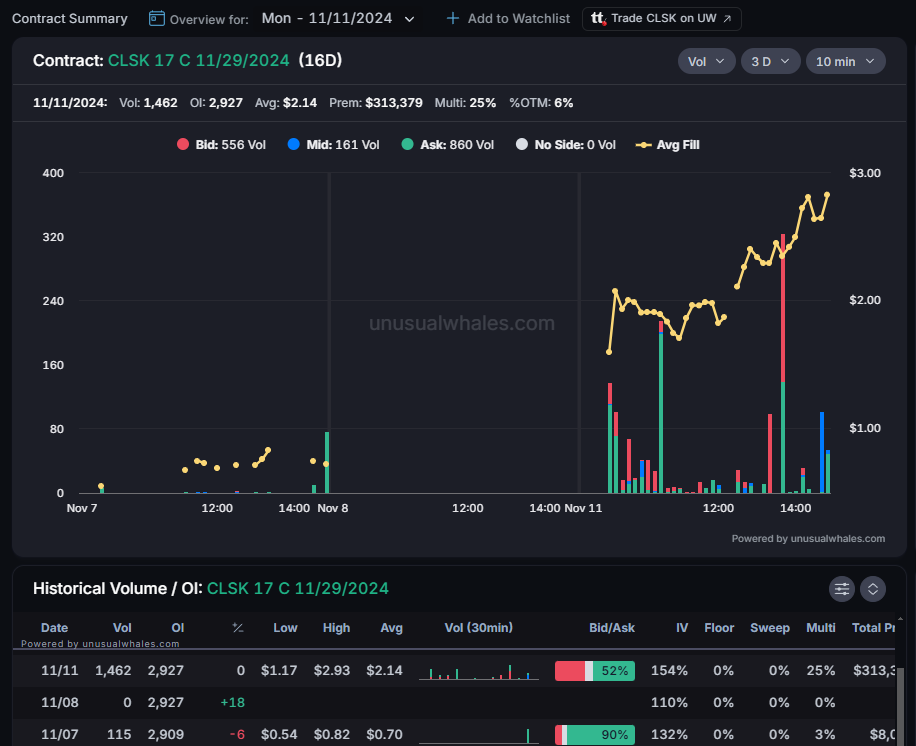

On the morning of October 16th, while $CLSK traded at $11.97 per share, around 750 contracts of the $17 call contract expiring on November 29th hit the tape at the ask price of $0.85 per contract for a total premium of roughly $63,000. The contract at the time of fill was 42% out of the money; a fairly wide gap from their entry below $12. The expiration date notably sits at just a few weeks following the election results in early November.

In the day that followed, this position experienced heavy drawdown, hitting a low of $0.40 per contract; an over 50% loss from the point of entry. The trader held, however, and on October 18th, we saw more action on the contract.

Another 1,275 contracts transacted at the ask price of $1.10; bringing the total size to around 2,000 contracts with a total premium of $204,000 (First order of $0.85 * 750, plus $1.10 * 1,275, for an average fill price of $1.02) Following that order, once again, the trade experienced substantial drawdown, falling as low as $0.49 again on October 28th. At this point, the trader sat in losses of -52% to the tune of -$106,000 in the red.

That drawdown wasn’t permanent, however.

As time flowed into November, and the election came and went, Bitcoin continued its rally all the way up above $90,000. The Bitcoin miners finally began to give their opinions on the matter following the election results on November 6th. During pre-market trading hours on November 6th, $CLSK dropped to a low of $11.40 per share. However, as the day continued, buyers stepped in, driving $CLSK to a November 6th high of $13.07 per share.

November 7th was a little quieter, tapping highs of $13.82, but after the weekend, $CLSK saw some serious momentum follow-through.

After the weekend, $CLSK gapped up handsomely from a Friday close of $13.52 to a Monday open of $15.01. Throughout the day, momentum never slowed, taking $CLSK to new highs. During the last hour of trading, $CLSK hit its highest point of regular hours trading at $17.90. Naturally, the $17C 11/29/2024 reflected the over 30% ripper in the underlying.

From the point of open and 42% out of the money, the $17 call contract found itself $0.90 (or 5%) in the money. The contract value reached as high as $2.93 per, and while we do see some evidence of a partial exit near highs, this position remains fully open. At peak, the $204,000 total premium sat at $586,000!! That’s a 187% gain!

While the $CLSK stock price did see higher highs at $18.82 during pre-market trading on November 12th, options don’t transact outside of regular hours. Therefore, that $17.90 point in the underlying, and $2.93 price on the contract both reflected the highest values, thus far. As mentioned, there is a chance that part of this position was closed or changed hands, but even if that’s true, a portion of this position absolutely remains open.

Will Bitcoin continue on, through the long-awaited $100,000 price point, dragging miners with it to new highs?

We’ll see; either way, we’ll continue tracking and sharing all things unusual

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.