Unusual Options in OUST after Department of Defense's Blue UAS Cleared List, 6/11/2025

In this issue, we’re going to walk through some unusually well-timed options trades in Ouster, $OUST; all of which opened before a June 11th announcement that their OS1 digital lidar sensor had been added to the Department of Defense’s Blue UAS Cleared List.

Following that news, $OUST shares ripped as much as +27% intraday, with several far-out-of-the-money call options exploding in value. What makes this particularly interesting is when, and how aggressively, the positions opened. These trades weren’t near-the-money momentum scalps. They were wide, directional bets taken in size. Let’s break each one down, one at a time.

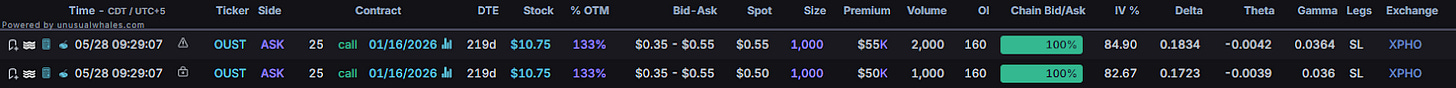

We’ll start with the January 2026 $25 call contracts.

These hit the tape on May 28th, with 2,750 contracts filled at $0.58 per contract, all at the ask. At the time, the stock was trading down at $10.75, which made these calls a full 133% out of the money. That’s deep, and it’s not something you usually see get pressed with that kind of size in a low-volume small-cap (described as stocks with <$1B in market cap, which $OUST was before the news, certainly not after).

Open interest here carried over and is still holding. That’s worth repeating; this position remains open, suggesting whoever took it isn’t just flipping short-term momentum.

At the highs on June 11th, this contract traded at $4.55, a gain of 684%:

Entry: $0.58

High: $4.55

(4.55 - 0.58) ÷ 0.58 = +684%

No signs of trimming, no signs of closing.

Let’s move on to the January 2026 $20 call contracts.

This trade went up on June 6th, when 1,500 contracts filled at $1.57 per contract, again ask-side. At the time, $OUST was trading at $12.32, so these were 62% out of the money. This setup mirrors the $25C play: long-dated, far OTM, and opened cleanly without any signs of multi-leg confusion. These also remain open at the time of writing. By June 11th, the $20C traded as high as $6.45, a move of 311%:

Entry: $1.57

High: $6.45

(6.45 - 1.57) ÷ 1.57 = +311%

That’s not likely to be a short time frame flip. That’s someone staking size on a name that, to most of the market, looked like it was just grinding in the same range for over a year.

And like the $25s, the fact that these remain open through the initial pop is telling.

Now for the most time-sensitive trade of the bunch: the July 2025 $20 calls.

This one hit the tape on June 10th, just one day before the Department of Defense news was made public. Over 5,000 contracts traded in total, with 1,800+ carrying over into open interest. Fill structure here wasn’t quite as clean as the January trades, because the tape showed a mix of bid and ask fills, but early orders hit at the ask and held a consistent price of $0.90, even as the bid/ask spread moved around them.

Stock was trading at $16.73 at the time, putting these roughly 20% out of the money; not nearly as wide as the Jan setups, but still outside the realm of typical scalps.

On June 11th, these calls ripped to a high of $2.90, a gain of 222%:

Entry: $0.90

High: $2.90

(2.90 - 0.90) ÷ 0.90 = +222%

We’ve seen some potential partial exits around the $1.49 area, which would’ve still locked in a 65% gain for those trims. But we’ll need to see open interest drop tomorrow, given today’s above open interest volume, to be sure..

So what do we make of all this?

These weren’t choppy day trades. None of these entries were close to the money. And none of the setups gave off that usual “chart breakout” vibe that often attracts crowd flow. These were well-sized, clearly defined, directional bets made ahead of a news catalyst that turned out to be the real deal.

Do we know for sure that these trades constitute informed, insider trading or informed flow? Of course not, but the structure and timing of these trades sort of speak for themselves: far OTM, pre-news, no spreads, no rolls, no immediate exits. Just clean(ish) conviction. And given we’ve just done two other articles on Navitas+Nvidia and Applied Digita+CoreWeave, well… it really makes ya think.

Thank you as always for reading! REMEMBER!! You can find articles like this and MANY others about Options and the Unusual Whales Platform on the Information Hub!!

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.