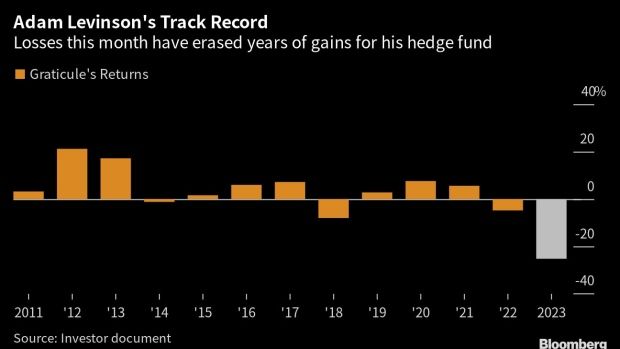

Adam Levinson is shutting down his hedge fund, worth billions, after being hit by losses amid ongoing bond market volatility, per Bloomberg.

Levinson’s Graticule Asia macro hedge fund has plunged more than 25% this year.

The Fortress Asia Macro fund, which began trading in 2011, was the predecessor to Graticule, which grew to manage $4.5 billion by March 2016.

Last year, when most large macro hedge fund posted gains by betting on rising interest rates, Levinson’s hedge fund lost 4.7%.

In Feb, hedge funds betting against stocks globally abandoned those trades last week at the fastest pace since 2015, per Goldman Sachs.

Read more: https://unusualwhales.com/news/hedge-funds-betting-against-stocks-globally-abandoned-those-trades-last-week-at-the-fastest-pace-since-2015