Flow Review $SMCI, October 2024: Walking through SMCI Unusual Flow

In this article, we’re going to cover two well-timed, eyebrow raising trades on Supermicro Computer, $SMCI. The order hit the tape, spotted in the Unusual Whales Flow Feed, just one day before major news led to a dramatic move in the underlying stock price.

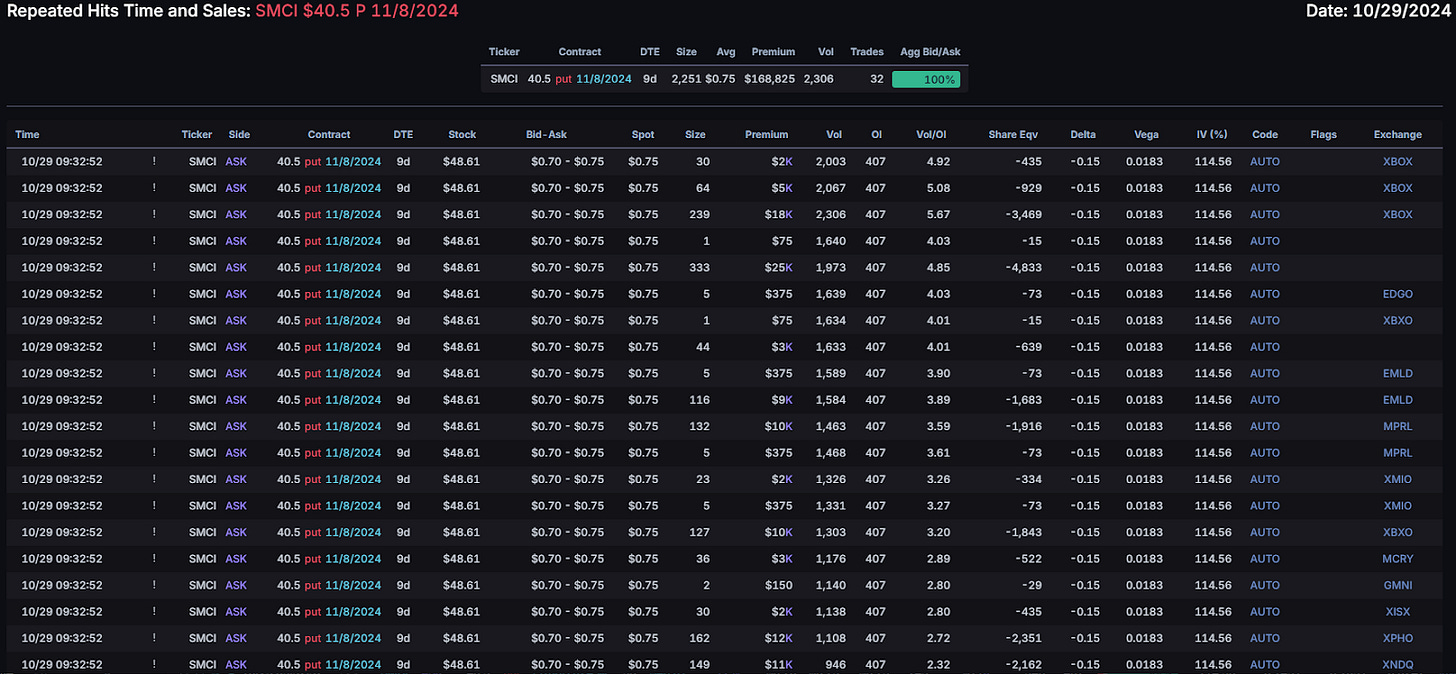

Our tale of the tape begins at 9:32am Central Time, when a series of transactions on the $SMCI $40.5P expiring on November 8th, 2024 filled the flow feed.

A total 2,251 contracts transacted across numerous orders and exchanges, at the ask price of $0.75, triggering a Repeated Hits Flow Alert. The total premium spent on this position was just shy of $169k at $168,825. Given the general lack of open interest (407) versus the overall position, we can deduce that this was a newly opened position. At the time of the fills, $SMCI traded at $48.61 per share, which placed this contract at around 22% out of the money with just 9 days until expiry. Quite the order…

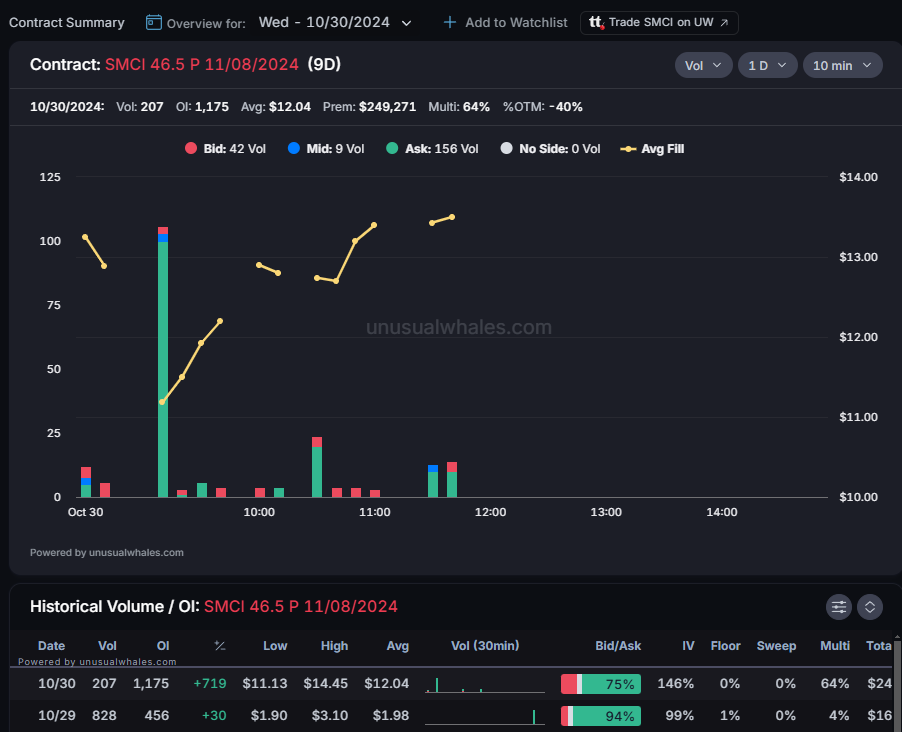

Throughout the rest of the trading session, not much else grabbed our attention. Until about 6 minutes before close, that is. At 2:54pm Central time, another flurry of $SMCI orders hit the tape.

While this position on the $46.5P also expiring on November 8th carried a smaller contract size, the manner of the fills remains the same. Across several orders, 721 contracts transacted at the ask price of $1.95 for a total premium of $140,595. When this position filled, $SMCI traded a little higher than the morning session, at $49.29 per share, placing this $46.5P just 6% out of the money with 9 days until expiration. The timing of this trade was also interesting, especially having hit the tape just minutes before the market closed.

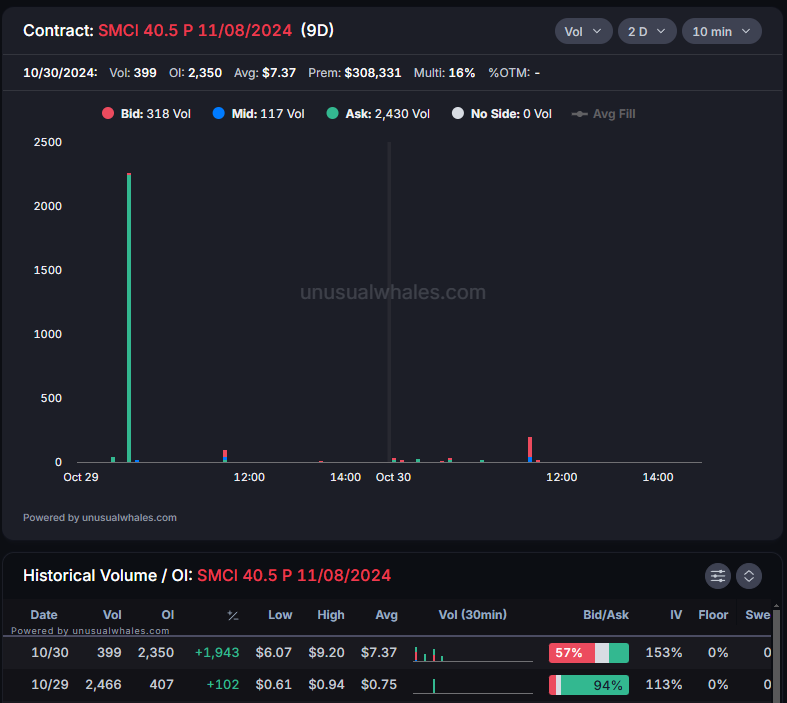

Neither position saw anything special going into the market close. The morning of October 30th however carried with it some serious fireworks for anyone betting on $SMCI’s downside.

A filing reported that accounting firm Ernst & Young terminated their relationship with Supermicro. In the filing, Ernst & Young stated “We are resigning due to information that has recently come to our attention, which has led us to no longer be able to rely on management’s and the Audit Committee’s representations….” They went on to say, “we can no longer provide the Audit Services in accordance with applicable law or professional obligations.”

The reaction by investors was swift and violent.

Supermicro tanked over 30% instantly, from nearly $49 per share to a low of $30.37. Naturally, the value of both put contract positions exploded from this news.

The $40.5P, once 22% out of the money, found itself roughly 25% *in* the money. The value of this contract hit an intraday high on of $9.20. That’s quite a dramatic jump from their entry point of $0.75, posting a 1,126% gain overnight. The story on our other tracked position followed the same plot.

From the trader’s entry at $1.95, the $46.5P, now nearly 35% in the money, traded as high as $14.45 per contract. That’s a 641% increase from market close to market open.

$40.5P 11/08/2024 | $0.75 → $9.20 | +1,126%

$46.5P 11/08/2024 | $1.95 → $14.45 | +641%

The timing of both orders falling just one day before a major news event is definitely interesting. It’s impossible to say whether or not this sort of aggressive, out of the money put buying would occur, or would reap any sort of comparable benefit, without the filing of Ernst & Young’s departure. But it’s definitely unusual. At the time of writing, there was no concrete evidence of positional closures for these two contracts.

NOTE: This post is not financial advice. The stock market is risky, and any trade or investment is expected to have some, or total, loss. Please do research before any trade. Do not use this information for investment decisions. Check terms on site for full terms. Agree to terms before considering this information.