4 weeks ago, Cboe Global Markets Inc went live with their Pan-European Derivatives Market. This marked a important milestone for a real Europe-wide market as we are still far away from that – especially when compared to the US market.

In this post we’ll take a brief look at Cboe, dive a bit deeper into their new European platform and examine the first 4 trading weeks since it’s exception. Will we already find unusual activity or even whales?

I’m well aware most of our readers are from the US and not familiar with the European market, so let’s start with a quick option focused overview of the main differences between the markets before diving into the main topic.

TL;DR

· The European equity option market is very fragmented and small compared to the US market.

· The Cboe is pushing into the European market to create a centralised option market.

· The platform launched on the 6th September 2021.

· The Cboe has big plans for the future, but the platform is still in an early adoption phase by the market participants.

The European equity option market

While Europe and especially the European Union are very keen on presenting themselves as a strong and united entity, there are still a lot of areas with strong segregation between the countries. Unfortunately, the equity market is one of them. Europe has 36 national stock exchanges, 2 Pan-European stock exchanges and 28 future exchanges. While the US also boast an impressive 19 stock exchanges, there is one important distinction: They are all connected and regulated by the same laws.

This problem gets even worse with derivatives – the equity options market in the US is centralised and every trade is funnelled through the Cboe. This provides very good liquidity and low trading costs –two important factors in making a market retail friendly. The centralisation also leads to transparency, which allows services like Unusual Whales to monitor and decipher trading activity.

In Europe no comparable market exists (yet.) EUREX (European Exchange) is by far the biggest exchange offering equity options across the major European markets. They currently offer monthly and weekly options on 538 equities.

In relation to the 6388 stocks available across the main national exchanges that makes just 8.4% of the European tickers optionable. For comparison: According to tradingview the NYSE and Nasdaq currently list 7586 stocks of which 4545 are optionable through the Cboe, an impressive 59.9%.

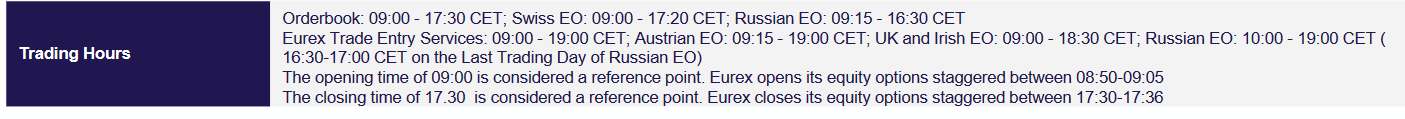

EUREX has had a market share in equity options of roughly 70% in 2020 – the rest is split between the French/Belgium based Euronext with roughly 10-15% and some smaller exchanges across Europe. This highlights how fragmented the market is, making it hard for retail traders to stay on top of the game or even find the right instrument to trade. I will end this chapter with an overview of option trading hours on EUREX. Just absorb that for a minute. It should be clear by now, why so many European traders instead choose the US market for their daily trading needs.

The Cboe and their big plans for Europe

Cboe Global Markets is a multinational company specialised in creating markets across various asset classes. Most noteworthy is the US based Cboe Options Exchange: the biggest equity option market in the world and also what most people associate those 4 letters with. Apart from that they also created widely known indices like the VIX (Cboe Volatility Index).

In July 2020 the Cboe announced it’s plan to expand their option-based business from the US to Europe. Originally planned for the first half of 2021 it was delayed due to the Brexit creating a lot of regulatory uncertainties that needed to be sorted out first. The platform went live on the 6th September 2021 with 6 index options and corresponding index futures.

This doesn’t sound exciting based on that number, but it’s all about the details with this one. As those products were designed from the ground up the Cboe was able to channel all their experience from decades of providing option markets in the US into them. And this really shows:

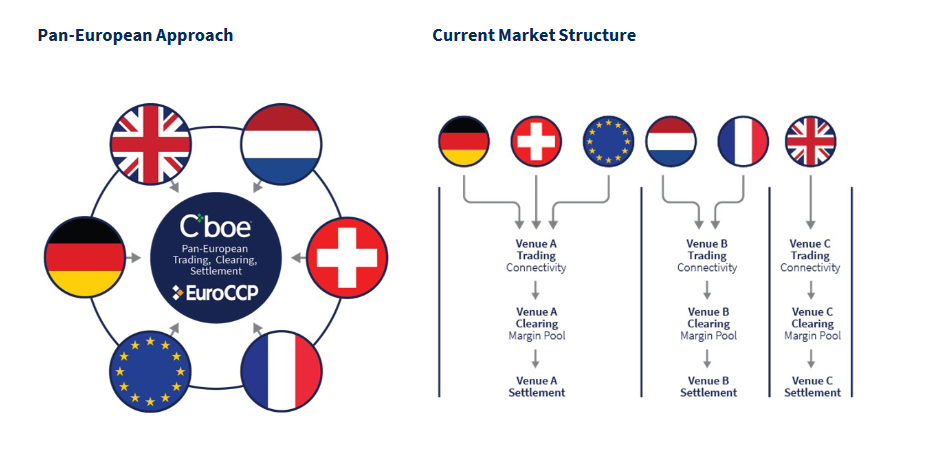

· All indices are designed by the same principles and based on the same mathematical rules, leading to easier comparisons, benchmarking, and risk balancing.

· The options and futures have fixed contract multipliers of 100 for easier delta hedging on the market maker side (Contract multipliers on EUREX can range from 5 to 5000).

· The option and futures are traded through one centralised exchange, providing better liquidity and transparency for all participants.

The following graph showcases the Cboe based option model compared to the traditional European one:

After an adoption phase the Cboe is planning to expand their offering by additional products. Ade Cordell, President of Cboe NL said in an interview in June 2021:

“Additional equity index and equity derivative products will be phased in over time, including single stock derivatives. Volatility products similar to the VIX for the European market could also be on the horizon…”

While this sounds quite conservative, it’s very likely from my perspective that they will strive to enlarge their portfolio as quickly as possible. As an exchange their revenue is mainly based on trading volume. Creating an attractive option market for retail traders would surely help with creating volume as the recent surge in US option trading has shown.

Action! The first 4 weeks of trading in review.

The focus seems to be really on adoption right now. Market participants are testing the waters with low volume trades, but so far it’s slow. Like really, really slow. On the bright side the Cboe Europe provides 15 minute delayed trade data as well as end of day summaries for free.

In total an outstanding amount of 8 options were traded throughout the month. They were accompanied by 58 future contracts.

The biggest trade by volume was 3 puts on the 400 strike of the EZ50 index (Eurozone 50) purchased on the 8th September. In true Cboe yolo fashion those were weeklies expiring on the 19th September – and of course they expired worthless. At this point we don’t know if the trader or the market maker had to deal with this intense loss of roughly 200 Euros, but I think they are fine regardless. This might have been a bit of irony, but the numbers are real.

Conclusion

As there simply is not more to report about right now, we will end this blog entry at this point. I will keep an eye on the Cboe Europe and will report again once the volume picks up or any new developments occur. If you are interested in more details about the European market, check out the various links provided in this post or visit the #Europe channel over on the Unusual whales discord.

Thanks for reading and may the flow be with you.

You can reach out to me via Twitter: https://twitter.com/m3zzee,

or on the Unusual Whales discord-server: mezzee | kevin.

Trump: I want no more property taxes across the United States

7/4/2025 10:14 PMTrump's "Big, Beautiful" has $1.1 trillion in health cuts and 11.8 million losing care

7/3/2025 7:31 PMTrump’s Big, Beautiful bill passes the House

7/3/2025 7:27 PMGas prices haven’t been this low for the Fourth of July since 2021

7/3/2025 4:32 PM

Stay Updated

Subscribe to our newsletter for the latest financial insights and news.