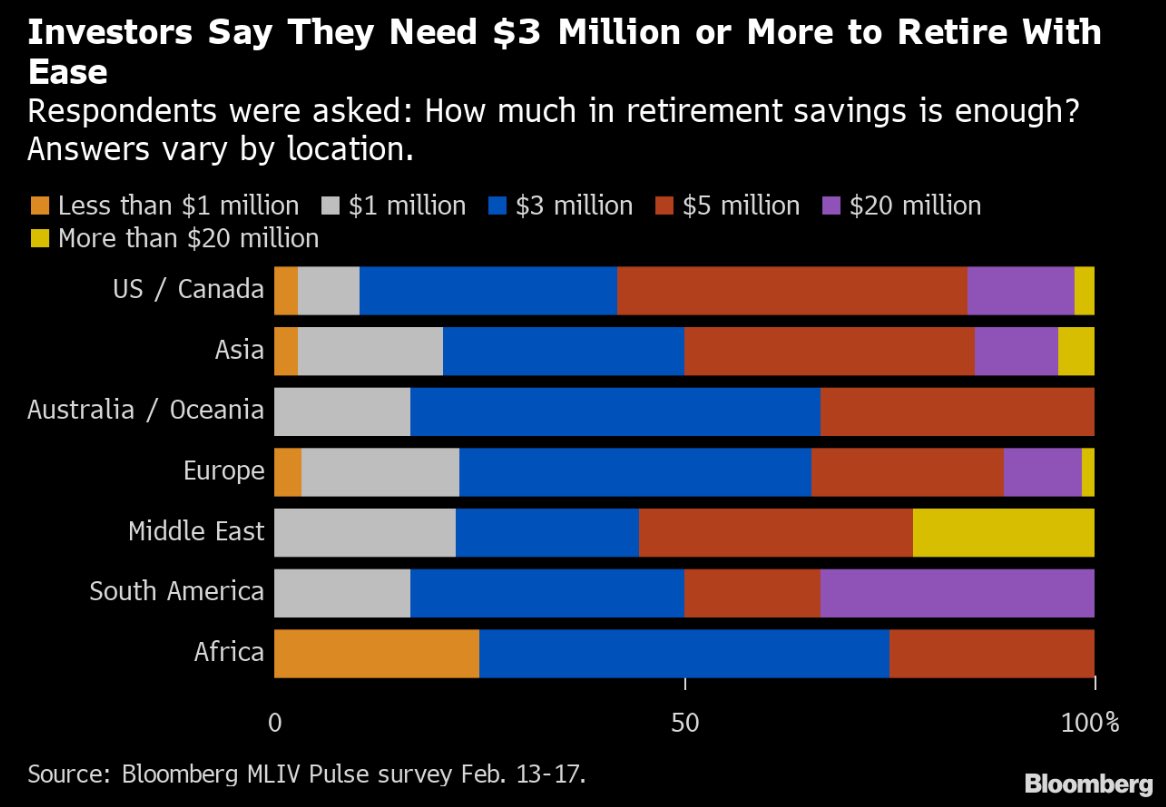

1/3 of investors say they need $3 million to retire comfortably, with another 1/3 say they need $5 million, per Bloomberg:

Meanwhile, a report by TransAmerica Center for Retirement studies dove into the average savings of different age groups, namely Gen Z, Gen Y (millennials), Gen X, and Baby Boomers. Another article by USA Today shares the different age ranges of those groups.

Here are the age groups and the average amount they have in their retirement savings.

- Gen Z - people born from 1997 to 2012 - have a median of $33,000 in retirement savings.

- Gen Y (millennials) - people born from 1981 to 1996 - have a median of $50,000 in retirement savings.

- Gen X - people born from 1965 to 1980 - have a median of $87,000 in retirement savings.

- Baby Boomers - people born from 1946 to 1964 have a median of $162,000 in retirement savings.

Gen Z workers put in an average higher than what experts recommend. Gen Zers place 20% of their annual salary directly into a 401(k) or a similar plan, while experts only recommend 10% to 15% of one's income.

Recently, it was found that Gen Y and Gen Z were among the largest groups that had the most personal luxury purchases in 2022 alone. Throughout that year, global personal luxury goods sales grew by 22%.

The news also comes when American personal savings dropped to a 17-year low. This is all while household debt continues to climb.

See flow at unusualwhales.com/flow.

Other News: