Wednesday morning saw a block of 32,000 AAPL 135p 4/2023 contracts traded.

This transaction has been noticed by many who follow options flow, and mentions of this particular trade were quite numerous. Among the many mentions include references that this trade took place 'above the ask.'

Here's why this trade didn't actually take place 'above the ask'.

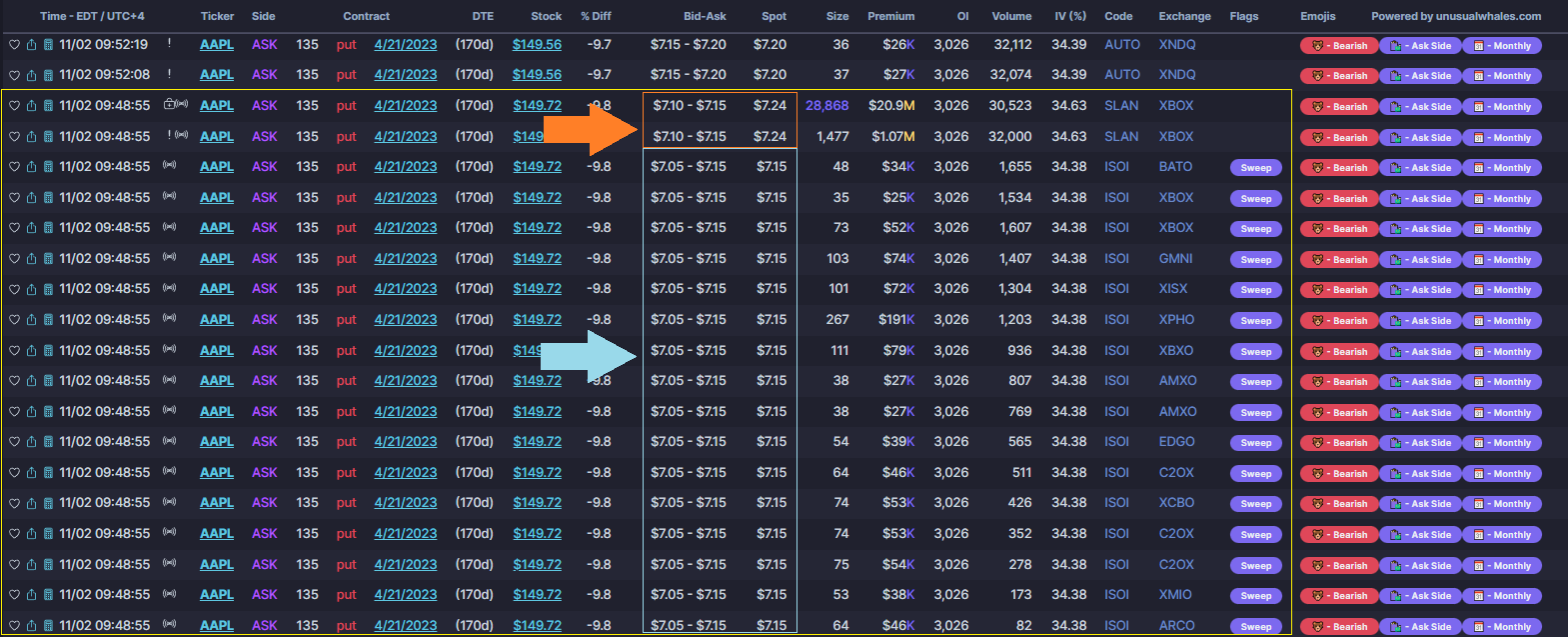

The large yellow box represents the singular 32000 contract trade.

The first ~1655 contracts (in blue) were filled 'at the ask' of 7.15.

The remainder (orange) were also filled 'at the ask'. It does appear that given the spot price and the ask price that they came in 'above the ask', but trading outside of the bid-ask spread is not possible.

It's likely that there simply was not enough volume 'at the ask' to fill the entire order so the order was split and executed at several price levels. This would show up as separate trades, as seen above.

The BLUE block of trades were the first that hit the tape and they cleared the entire level of 7.15.

The remaining contracts in ORANGE were purchased at the next available best price where there was additional liquidity available (7.24), but the NBBO lagged and still displayed 7.15.

Lags in the NBBO reporting can be explained by either a high frequency of trades or if a large trade is split and executed across multiple price levels. Both may be at play in this particular example.