About 67% of millennials who want to own a home at some point in their lives have no money saved for a down payment and 18% have less than $10,000, per Bloomberg.

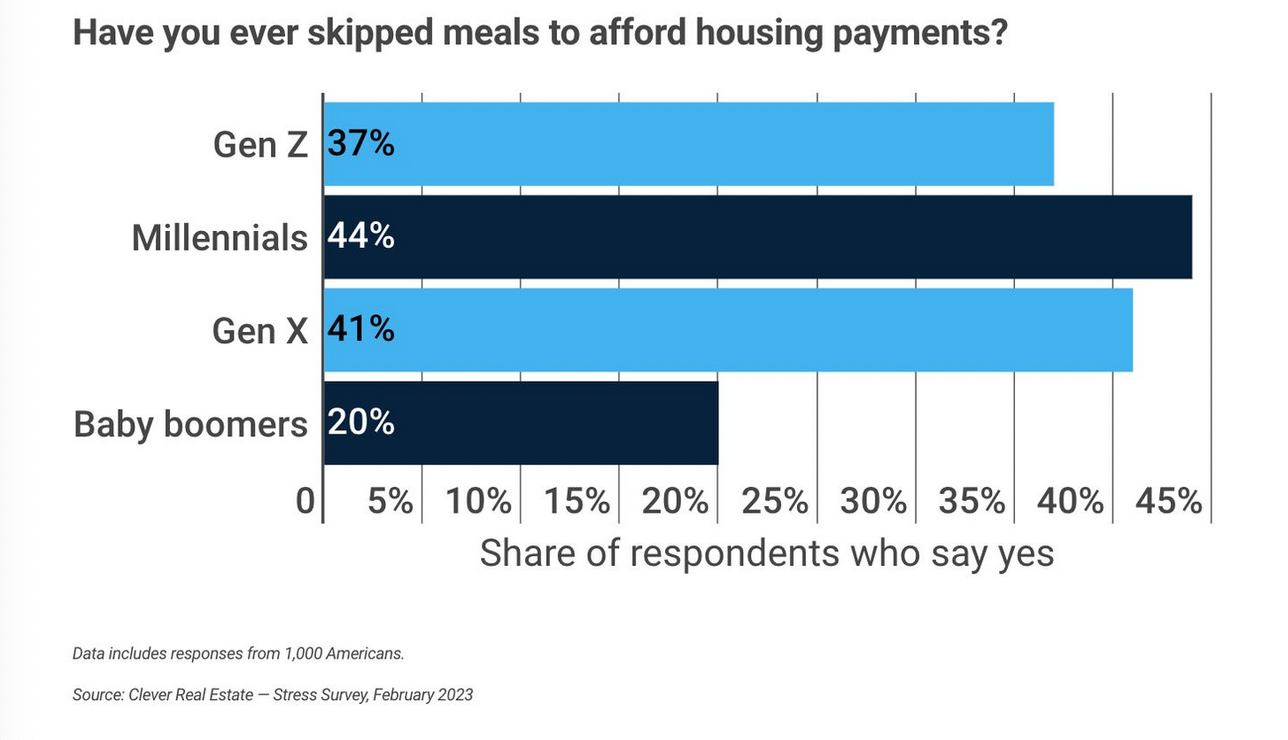

Meanwhile, 39% of Americans say they’ve skipped meals to make housing payments, per Clever Real Estate survey.

And among millennials, that figure rose to 44%. Among Baby Boomers, it was 20%.

Meanwhile, Housing affordability in the US is near all-time-lows, per $GS.

In November, nationwide, households need six-figure incomes to comfortably afford the typical home for sale, according to a report by Redfin.

Last month, the nation’s home buyers needed to make about $107,000 annually, up from about $74,000 a year earlier, to afford a median-priced home, according to Redfin. That’s an increase of nearly 46%.

In the Philadelphia metropolitan area, the annual income needed to afford a home at the median sales price of $260,000 was about $70,000 last month, up from about $50,600 in October 2021. That’s a 38% increase.

The annual household income needed to afford median household mortgage payments stayed mostly stable for years, but the income threshold started rising at the start of last year, according to Redfin. Increases in home prices and mortgage interest rates have made homes less affordable.