When you decide to enter the stock market and buy (or short) a publicly listed security, you need to know only two pieces of information: the company’s name and the current price that its shares are trading at. While it is highly advisable to do some more research such as technical and fundamental analysis before entering a position, those two tidbits of information convey all the information needed to know what you are buying.

If you want to trade stock options, there is a bit more information that you need to know, but first, what is a stock option?

What Is A Stock Option?

A stock option is a contract that gives a buyer the right to buy or sell a stock at a specified price (strike price) at a preset date (expiration date) that is agreed upon before the transaction takes place. Options are a derivative of the underlying stock, meaning their value is based on the stock’s current value or price.

Stock options are sold as contracts and each contract covers 100 shares of company stock.

You can read more about the differences between stocks and stock options and how to trade both here.

Call Vs Put Options

Just like how before you enter a position on the stock market, you need to develop a thesis in which you decide which direction you believe the stock’s price will go in, either up or down. When trading company shares, if you believe that the stock will go up, you buy it whereas if you believe that the stock will fall, you short it.

When playing options, you still have to come up with a thesis on if you want to play the option on the long or short side. However, instead of buying or shorting, you purchase call or put options. Call options are options contracts that are bullish on the underlying stock’s future share price while put options are bearish (you can read more here).

Options Terms Defined

Strike Price

The strike price of an options contract is the specified price at which you can buy the underlying stock, regardless of what it is currently priced at. It is worthwhile to note that you do not have to buy the stock, a stock option merely gives you the chance to.

If you buy a call option, you want the underlying stock’s price to be higher than the strike price because that allows you to buy the stock at a discounted price. You then have the ability to sell the shares that you got at a lower price at market value and you pocket the difference as profit.

Conversely, when you buy a put option, you want the stock’s share price to be below the strike price as a put option gives you the right, but not the obligation, to sell a stock at the expiration date at the strike price, given the underlying stock’s price is lower than the strike price.

The kicker to this, however, is that if you plan on exercising the contract, you only have until the expiration date to do so.

Expiration Date

The expiration date is the last possible date that a stock option can be exercised.

If you have a call option and come to the expiration date, if the underlying stock’s share price is below the strike price, then the option will most times expire worthless (you can technically exercise it, however, it is illogical to do so). If you are holding a put option, unless the underlying stock’s price is below the strike price, then it will also most likely expire worthlessly.

The expiration date also tells you if your option is a weekly or monthly contract. As best said by the stock exchange Nasdaq, “Monthly options expire every month on the third Friday of the month, whereas weekly options expire almost every Friday and is issued on Thursdays.”

Premium

A stock option’s premium is the price you have to pay to purchase an options contract, times 100. Remember, an options contract covers 100 shares of the underlying stock, so the premium listed only represents 1/100 of the cost of the contract. For example, let’s say that stock $XYZ has a premium of $0.50, then it will cost $50 to purchase a single contract.

Unlike the strike price and expiration date, the premium is not fixed and instead is extremely volatile. The premium moves up and down based on a variety of factors, including the underlying stock’s price, time until expiration, and implied volatility (IV).

Many traders have no intention of ever exercising a stock option and instead rely on trading options contracts with the hope of selling it at a higher premium than what it was bought for. This speculative buying often presents the chance of greater percentage returns than if you were to only trade the underlying stock, albeit at more risk. Speculative buying options without a position in the underlying stock are called naked options.

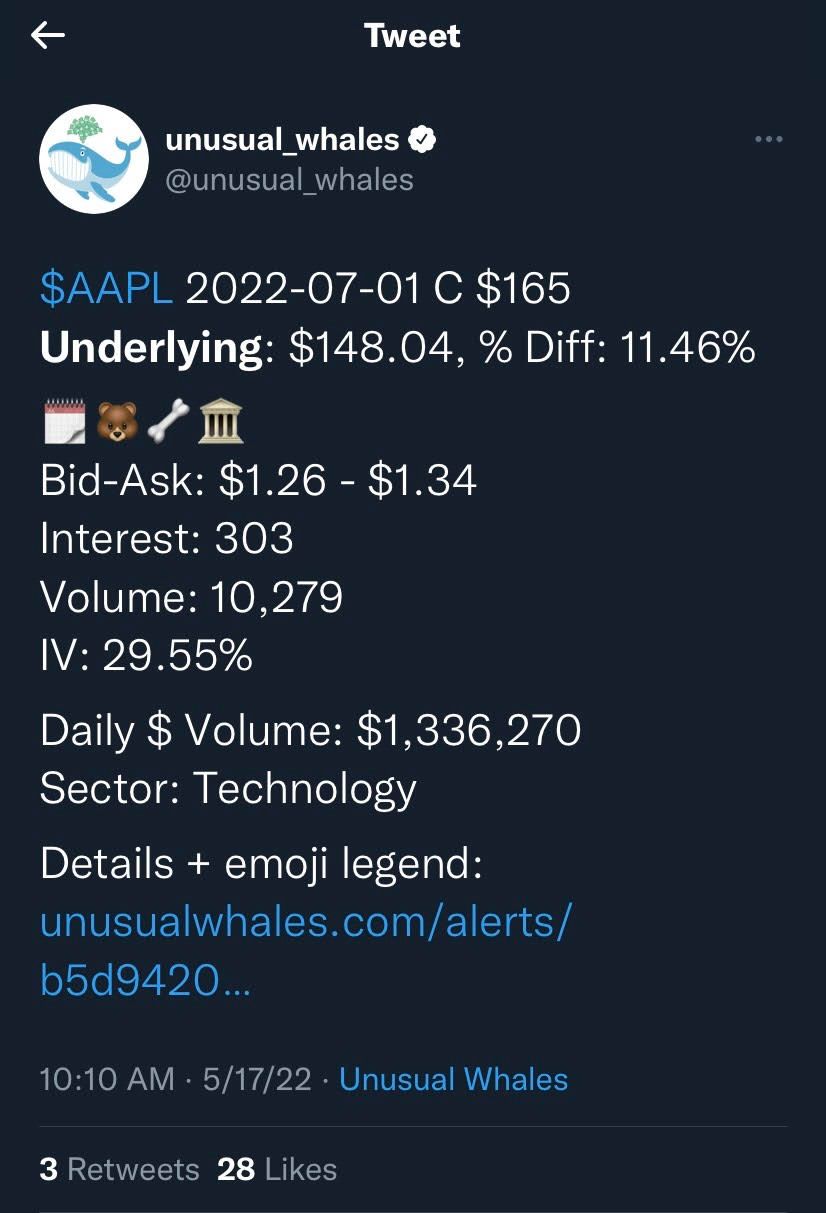

Trading Options With Unusual Whales

Unusual Whales is the premier provider of tools and access to information for retail traders in their quest for profitability. Whether it is unusual options activity, congressional trading tracking, or news flow, Unusual Whales is here to assist and give the ordinary trader what was once gate held by the big whales. For more on Unusual Whales click here.