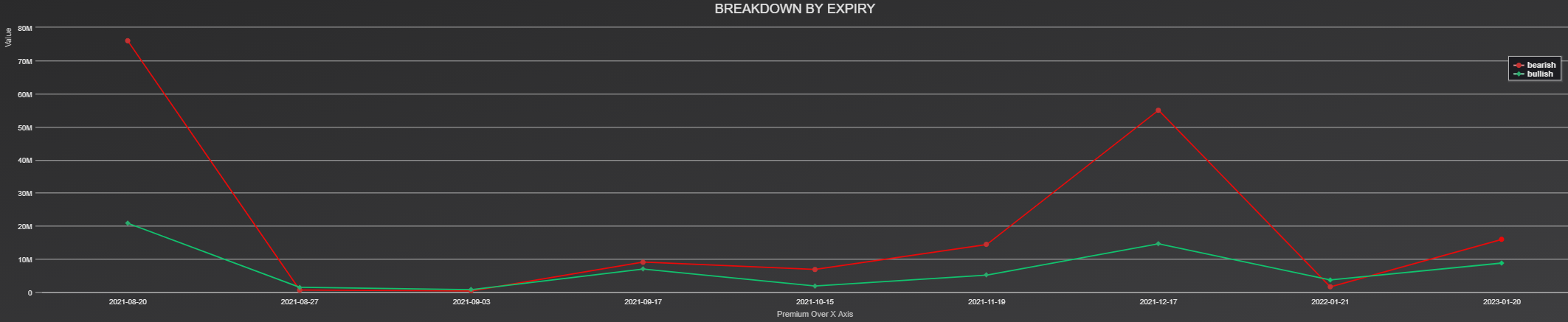

Today, among the underlying components of the NYSE, we saw unusual or noteworthy options trading volume and activity in Bank of America Corporation (Symbol: BAC). A total of 8,000 contracts, representing 800,000 shares, were purchased on the $45 strike put option expiring January 20th, 2023, This was matched with another 8,000 contracts sold on the $30 strike put option also expiring January 20th, 2023, The purchased volume was over the open interest, which was 2,200. It is worth noting that these positions are coming in just ahead of the upcoming Jackson Hole event. Per the chart below, it is evident that there are now more bearishly positioned bets on the January 20th, 2023 expiration.

Market Summary - Aug 17 2021

8/17/2021

AD_SHOULD_BE_HERE

Today among the underlying components of NYSEArca, we saw unusual and noteworthy options trading volume on the ARK Innovation ETF (Symbol: ARKK). The lot size was 8,000 contracts sold, which has increased the volume on this strike to 8.62K as of this writing.In the market capitalization-weighted index NASDAQ Global Select Market Composite (NasdaqGS), we saw unusual or noteworthy options trading volume and activity today in Western Digital Corporation (Symbol: WDC). A total 16,191 contracts were purchased

Trump: I want no more property taxes across the United States

7/4/2025 10:14 PMTrump's "Big, Beautiful" has $1.1 trillion in health cuts and 11.8 million losing care

7/3/2025 7:31 PMTrump’s Big, Beautiful bill passes the House

7/3/2025 7:27 PMGas prices haven’t been this low for the Fourth of July since 2021

7/3/2025 4:32 PM

Stay Updated

Subscribe to our newsletter for the latest financial insights and news.

Unusual Whales does not confirm the information's truthfulness or accuracy of the associated references, data, and cannot verify any of the information. Any content on this site or related pages are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. Nothing on Unusual Whales should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by Unusual Whales or any third party. Options, investing, trading is risky, and losses are more expected than profits. Please do own research before investing. Please only subscribe after reading our full terms and understanding options and the market, and the inherent risks of trading. It is highly recommended not to trade on this, or any, information from Unusual Whales. Markets are risky, and you will likely lose some or all of your capital. Please check our terms for full details.

Any content on this site or related pages are not intended to provide legal, tax, investment or insurance advice. Unusual Whales Inc. is not registered as a securities broker-dealer or an investment adviser with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority (“FINRA”) or any state securities regulatory authority. Nothing on Unusual Whales should be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by Unusual Whales or any third party. Certain investment planning tools available on Unusual Whales may provide general investment education based on your input. You are solely responsible for determining whether any investment, investment strategy, security or related transaction is appropriate for you based on your personal investment objectives, financial circumstances and risk tolerance. You should consult your legal or tax professional regarding your specific situation. See terms for more information.