Back on Thursday, September 23rd, we took a dive into the flow of Digital Turbine, Inc. (NASDAQ:APPS) based on heavy social media chatter and rating news for the stock. At the time, APPS had received an IBD Composite Rating boost from Investor’s Business Daily, to 91. This indicated to potential investors that the mobile software maker from Austin, Texas, had secured its place among the top 9% of all stocks within that rating system.

On Wednesday, September 22nd, the day prior to the Unusual Whales post, the APPS stock price closed at $70.41. As of today, October 20, 2021, less than one month after the IBD rating was given, APPS is trading over $86 per share.

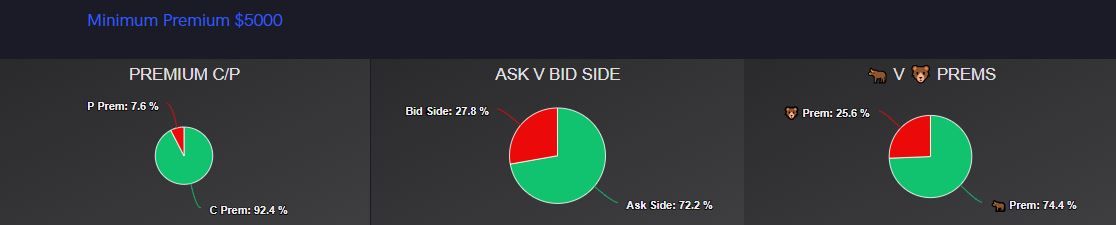

Looking back at the flow for APPS, the bullish sentiment we noted in our previous article seems to have maintained consistency during the last month.

At the end of September, ask-side flow for Digital Turbine Inc. was overwhelmingly bullish. The vast majority of order flow over $25k in premium was flagged by the tool as such, despite the fact that the price had fallen back about $2 per share since the IBD rating announcement.

Traders at the time focused heavily on the in the money $50 call strike, as well as the $75 call strike, expiring November 19, 2021. In addition to these, we noted numerous orders for out of the money strikes such as the $100 and $105 calls for January 20, 2023. This displayed a bullish sentiment in both the short and long terms.

Moving on to the second week of October, that bullish sentiment did not dissipate. The stock price continued its journey upward, breaking through the $70-79 range into the $80s, and the flow continued to reflect the positive sentiment for the future. By October, traders were placing more emphasis on those longer dated expirations. We see heavy flow on the $70 call (by now, in the money) for January 2022. The $80 call for January 20, 2023 also received more attention than before. At the end of trading on Friday, October 8th, 2021, APPS had worked its way above $80 before settling to close at $79.38.

By October 15, the APPS stock price had broken $85 per share. After such a run, one would potentially expect bullish sentiment to somewhat dissipate. However, according to the flow, this is not the case. The same outlook from September holds true in the flow this week, as short dated calls and LEAPs alike continue to flow in. Today, October 20, 2021, the flow on Digital Turbine Inc. is no different.

Elon Musk has said: The Trump tariffs will cause a recession in the second half of this year

6/5/2025 8:32 PMTrump has said: I don’t mind Elon turning against me, but he should have done so months ago

6/5/2025 8:27 PMElon Musk has endorsed a post saying Trump should be impeached

6/5/2025 8:26 PMElon Musk has said: In light of the President’s statement about cancellation of my government contracts, SpaceX will begin decommissioning its Dragon spacecraft immediately

6/5/2025 8:22 PM

Stay Updated

Subscribe to our newsletter for the latest financial insights and news.