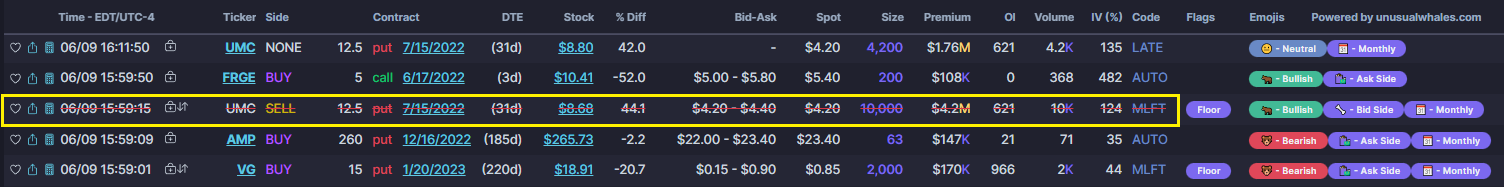

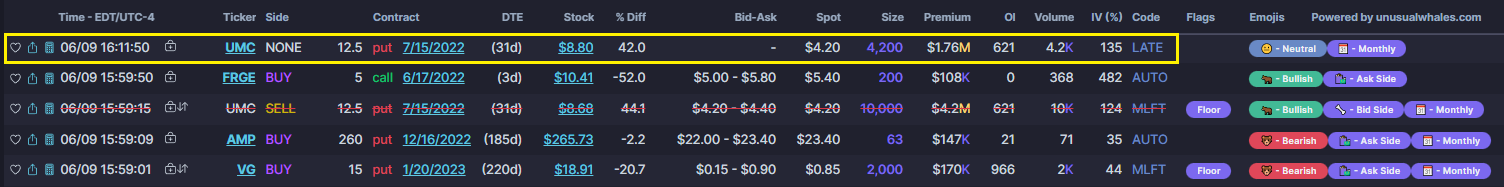

You may have noticed some flow trades have a red line running across the entire line of data.

Per the SEC:

"the nullification or modification of transactions may be necessary for the maintenance of a fair and orderly market or the protection of investors and the public interest exist".

The SEC cites "verifiable systems disruptions and malfunctions" as a condition in which designated Trade Officials (employees/officers of the respective exchange) may act to review potentially erroneous transactions. This action must be initiated within 60 minutes of the original transaction.

Approximately 250 - 500 trades are nullified/modified daily. This is a normal occurrence.

Trades that have been reported as 'nullified' (cancelled) or 'modified' will be crossed out in red at the time that the nullification has been reported. Until then the trade will appear on the flow feed normally.

Trades that are 'modified' will be crossed out in red, with the resulting modification reported to the tape at the time it takes place. The resulting modified trade will (unfortunately) not have any labels to distinguish it as such.

Trump's "Big, Beautiful" has $1.1 trillion in health cuts and 11.8 million losing care

7/3/2025 7:31 PMTrump’s Big, Beautiful bill passes the House

7/3/2025 7:27 PMGas prices haven’t been this low for the Fourth of July since 2021

7/3/2025 4:32 PMTariffs are unlikely to result in much reshoring because production costs in other countries are well below the US

7/3/2025 4:28 PM

Stay Updated

Subscribe to our newsletter for the latest financial insights and news.