From 2021.

Over the past month, we’ve witnessed gross conflicts of interest come to light at the Federal Reserve System (the “Fed”). High-ranking officials like Jerome Powell, Rich Clarida, Rob Kaplan and Eric Rosengren have been caught trading securities while fulfilling the Fed’s main purpose of providing the nation with a safer, more flexible, and more stable monetary and financial system.

Many have asked how they have remained impartial while personally benefiting from their own monetary policies? Well, they can’t.

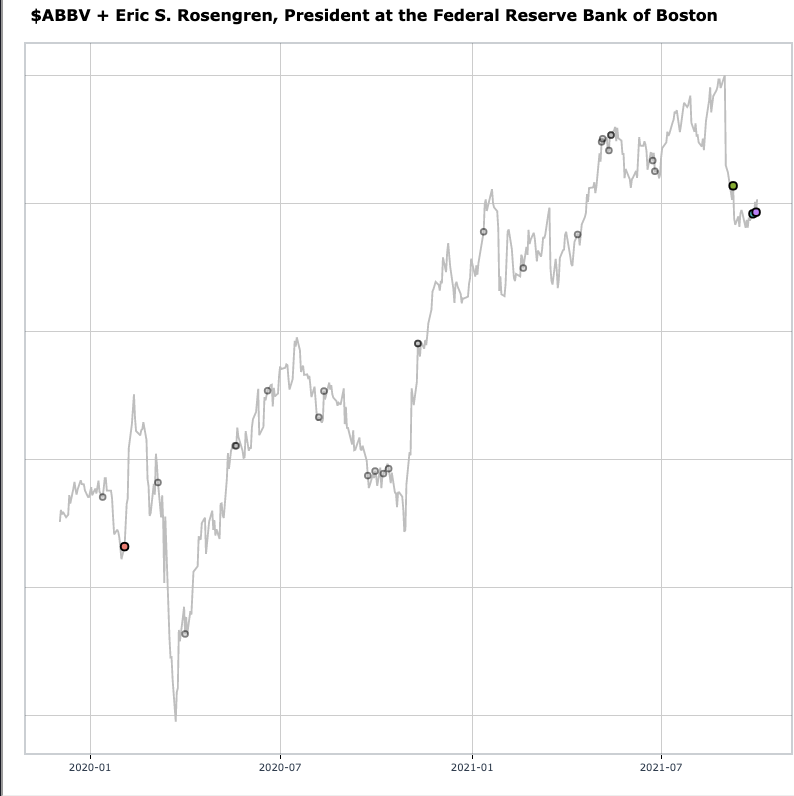

Last week, we witnessed the early retirement of Eric Rosengren, President of the Federal Reserve Bank of Boston. He was caught trading REITs while warning on real estate.

REITs that Rosengren invested in:

- Two Harbors Investment Corp (TWO)

- Invesco Mortgage Capital Inc (IVR)

- Annaly Capital Management Inc (NLY)

- AGNC Investment Corp (AGNC)

Check out his trading activity in 2020 (buys and sells), his speeches on monetary policy (grey dots), and significant breaking news stories. You can hover over the colored dots to see what the events were.

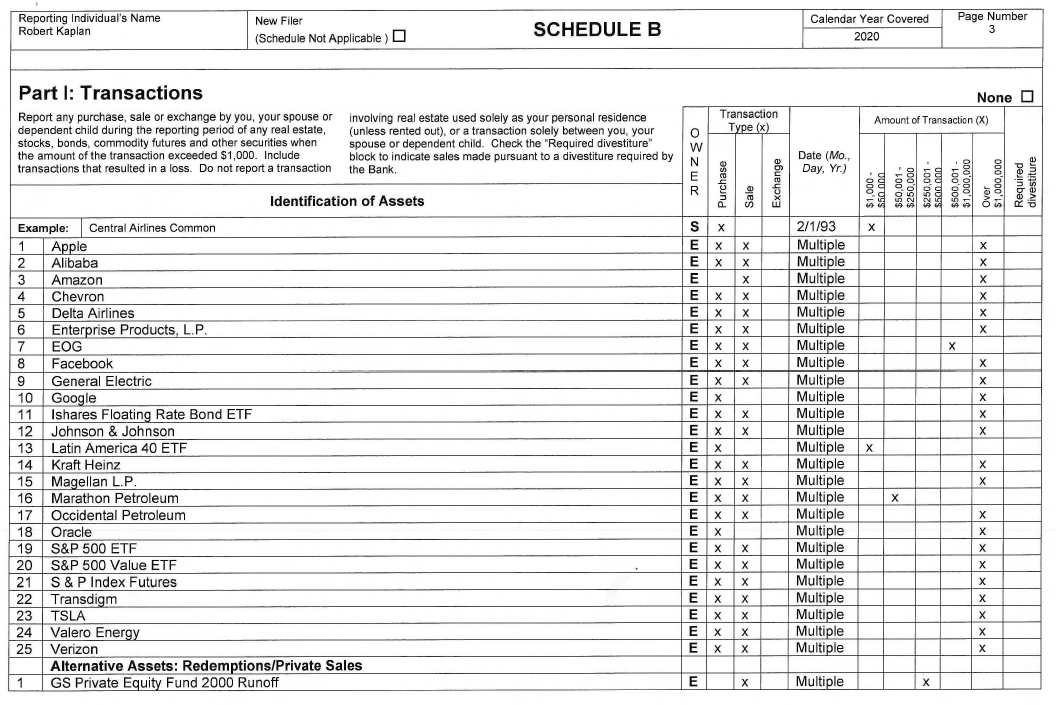

This week, Rob Kaplan, President of the Federal Reserve Bank of Dallas, will also retire early. He was caught trading millions in dozens of companies throughout 2020.

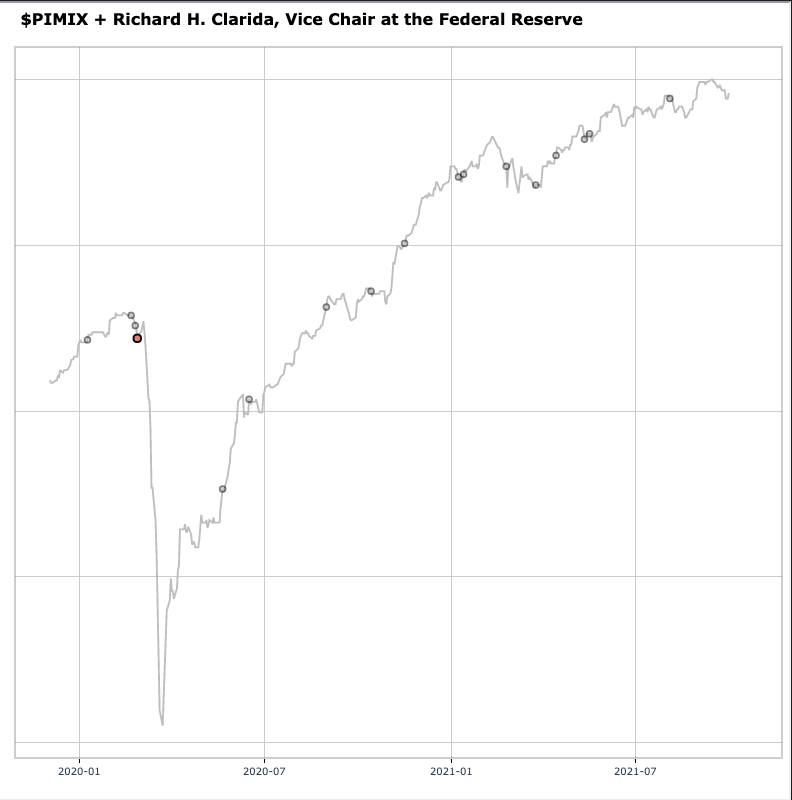

And just over the weekend, we found out that Vice Chair Rich Clarida sold millions in bonds (PIMIX) and bought millions in stock indices (PSTKX, USMV) the day before Powell warned that coronavirus could pose risks to the economy. We learned recently that he was in contact with Fed staff on days leading up to Powell’s announcement.

Check out Clarida’s 5 large trades in 2020 alongside his speech dates.

Select stock ticker:Select a ticker:PIMIXPSTKXSCHKUSMV

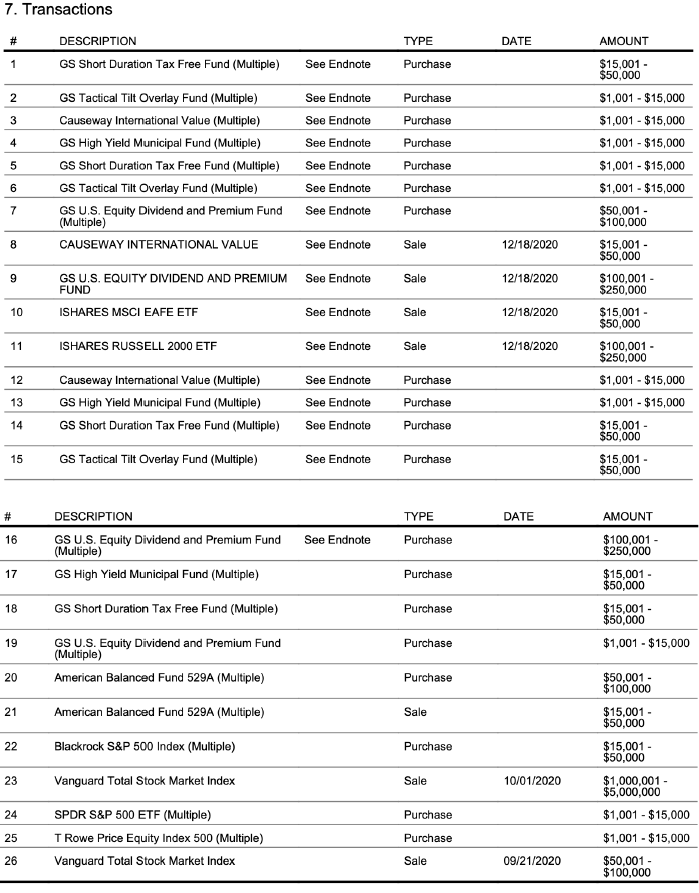

And top dog Fed Chair Jerome Powell is not innocent either. Here are his 2020 transactions made by him or the Powell Family Trusts (noted with “See Endnote”). He’s made trades in municipal bonds and stocks...

Where do we go from here?

Hard questions are currently being asked at the Fed. How could this have happened? How is this even allowed? When is Senator Liz Warren going to beat someone up? How do we prevent this from happening again?

We should all be disgusted with these seemingly unusual trades. Reviewing and revising disclosure procedures is a start. It’s absurd that Powell and Kaplan can just say they traded stocks “Multiple” times and leave out WHEN they actually made those trades. It’s absurd they can even trade. The majority of the 12 Reserve Bank Presidents do not trade. Just ban all Fed officials from trading. They know too much and wield too much monetary policy making power.

I will continue to root out insider trading, expose inequities in the markets and level the playing field for retail traders. I hope you join me. Together, we are whales.