Option Strategies Details

Short 100 Shares + Sell 1 OTM Put

1. Reduce the cost basis of shares 2. Generate a yield from short shares 3. Systematic profit-taking

Down

Neutral

Varies

Short Call

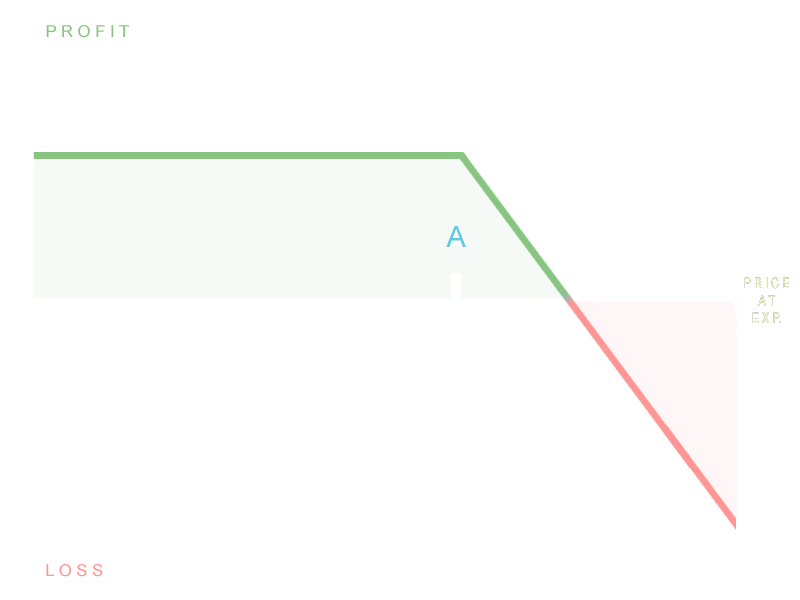

There is no potential 'loss' on the options contract, but this trade creates 'opportunity risk'. If the stock price decreases significantly below the strike price of the sold Put, the trader misses out on that additional price decrease because she is obliged to buy 100 shares at the strike price.

The cost basis of the shares minus the current price of the shares plus the credit received for selling the Put. (Theoretically the loss can be infinite, here is a non-infinite example: you are short 100 shares of stock XYZ with cost basis $100 per share and you sell a $95P for $3. Stock XYZ goes to $200. Your loss is $10,000 (the cost of the shares) - $20,000 (the current price) + $300 (the credit received for selling the Put) = -$9,700.)

Covered Put

Other names

You sell (or are already short) 100 shares and sell 1 OTM Put

Description

A trader who is short 100 shares of stock may sell (or write) a Covered Put. The trader receives a credit, called a premium, for selling the Put and is obliged to buy those 100 shares at the strike price of the Put.