What’s Happened?

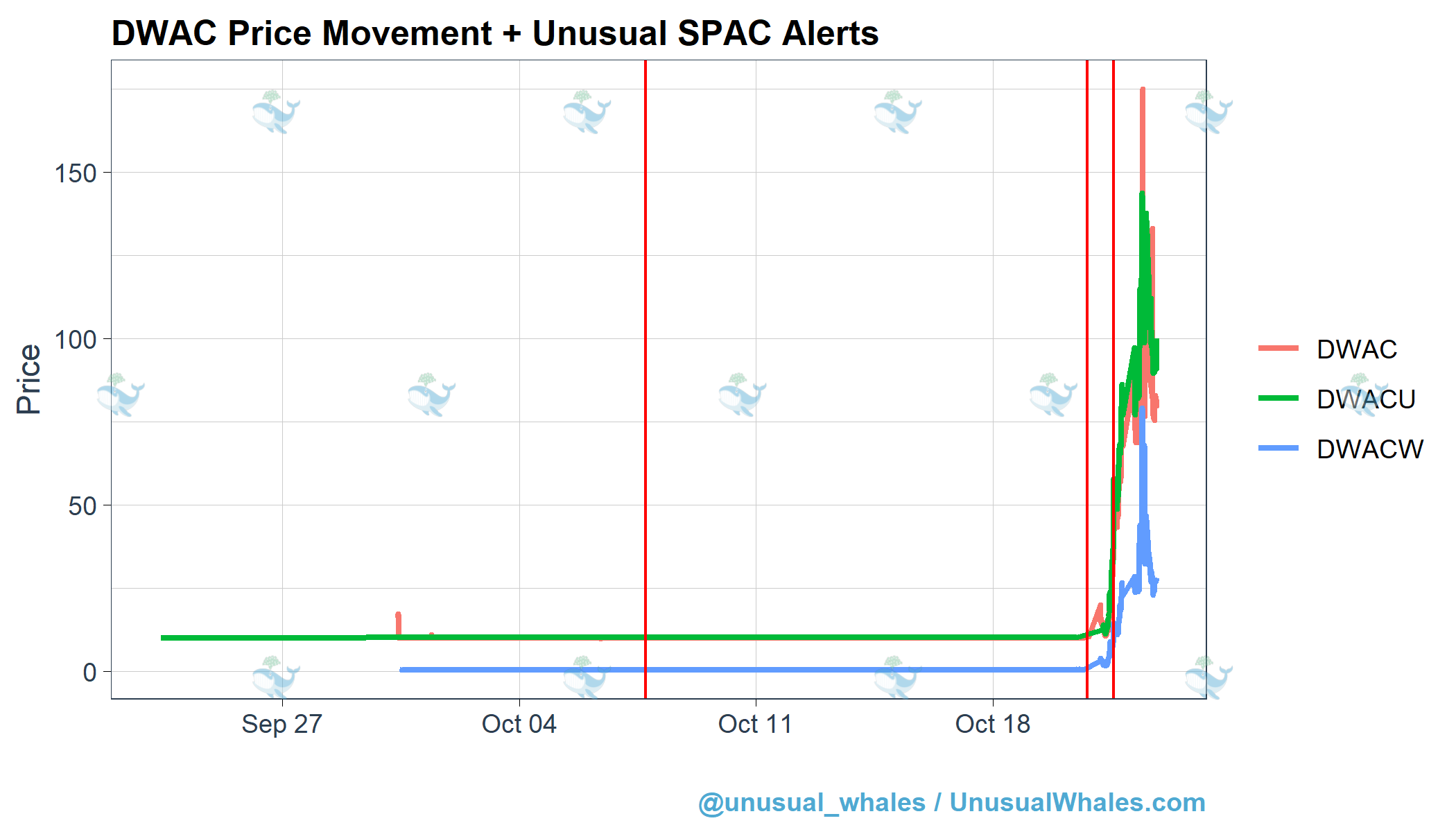

If you’ve been keeping up with market news the past week, then you’ve most likely seen what happened with the SPAC DWAC (Class A shares), along with its affiliated tickers DWACU (½ warrant and 1 Class A share awarded if held through merger) and DWACW (warrants exclusively, expiry 6/30/28).

Late on Wednesday, October 20th it was announced that DWAC (Digital World Acquisition Corporation) would merge with the former U.S. President Donald Trump’s Trump Media and Technology Group, or TMTG, public via a $300+ million dollar agreement. Trump’s company is set to launch several projects to compete with the likes of Twitter, Netflix, CNN, Fox, and eventually plans to expand to cloud services and compete with Amazon, Google, and many others in the game.

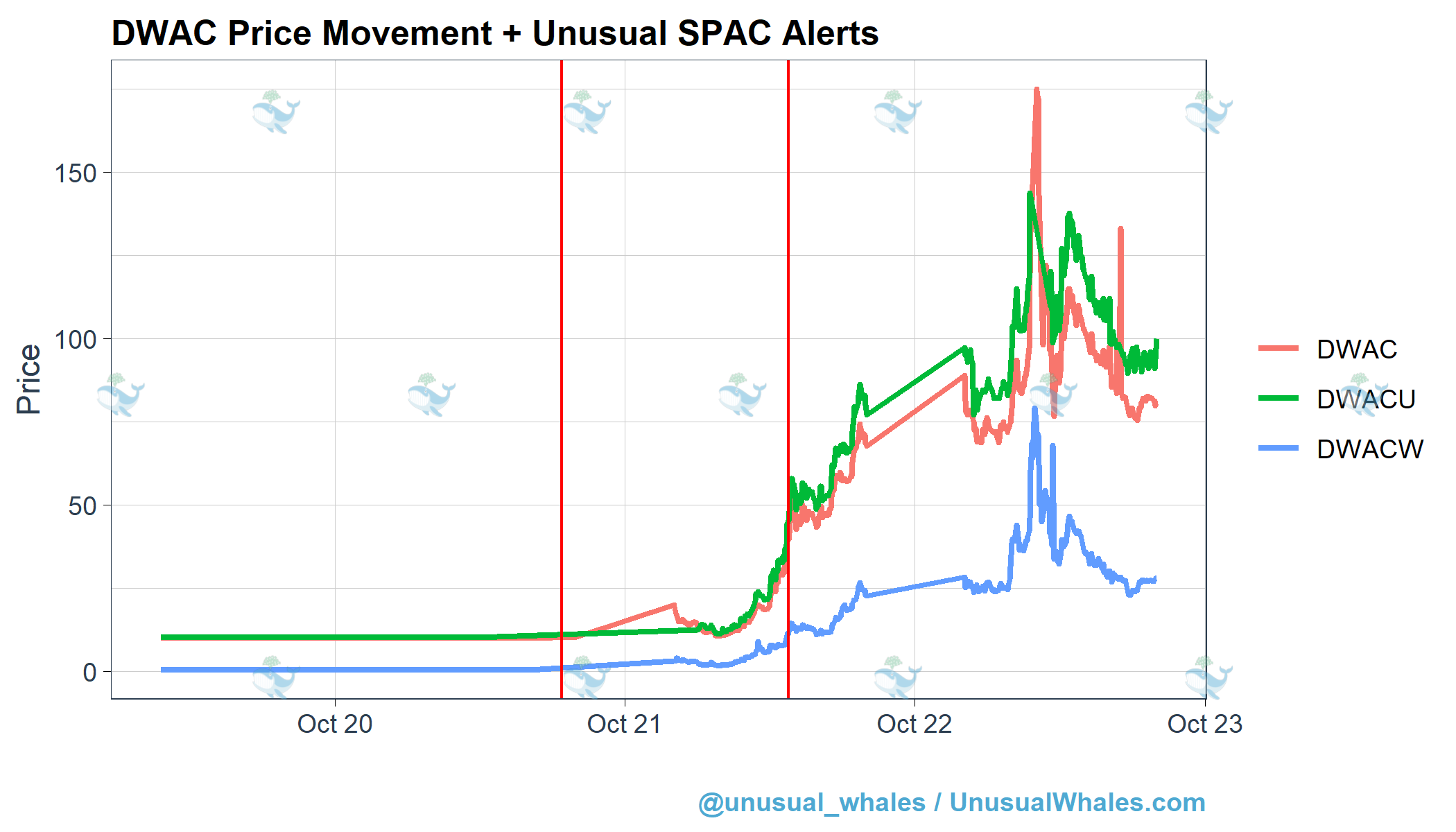

What’s more notable than Trump’s company going public is the reaction of DWAC stock price following the news. Shares of DWAC were trading at just under $10 prior to the announcement, and immediately saw the price double during the morning pre-market session of October 21st, before climbing to a high on the day of $52.

On October 22, shares continued their climb up to an astronomical $175 -- 1675% increase -- before settling around $90, still an 800% gain in 2 days time.

Trump, the Market Mover

Before Trump tweetlessly pumped his company’s stock, he was a key player in moving markets on his own through Twitter. In 2019, Trump’s tweets following the Jackson Hole economic symposium triggered a 400 point fall in the DOW 15 minutes after the tweets were sent. More recently, during discussions on the 2020 COVID-19 relief package, Trump had a heavy finger on the Tweet button, resulting in large dips in the market on 3 separate occasions. On October 6th, 2020 during the trading session, Trump tweeted:

I have instructed my representatives to stop negotiating until after the election when, immediately after I win, we will pass a major Stimulus Bill that focuses on hardworking Americans and Small Business

Shares of all 3 major indexes promptly fell nearly 2%. Later that same month, he continued tweeting about not reaching a deal on a COVID-19 relief bill, and indexes again were set back another 2% after their initial recovery.

On November 24th, 2020, Trump had tweeted about the Dow Jones Index breaking 30,000 for the first time in history along with appearing in a very short press conference, and naturally, the internet thought this was hilarious, and the market thought the top was called. The Dow fell about 175 points (.6%) by the session close.

On January 10th, 2021, Twitter announced that it was banning Trump from using its platform. Twitter shares sank as low as 12% the following session. However, as we’ve seen play out recently, Trump’s impact on stocks doesn’t just come when he has access to Twitter.

So what does this history of Trump have to do with DWAC? Well, lots. In fact, everything. President Donald Trump was one of the most followed Twitter users prior to his ban. His chaotic and blunt personality coupled with the inherent memey-ness of his internet announcements turned into a perfect storm causing a market frenzy. He was arguably, the world’s biggest influencer.

Upon announcement of the DWAC x TMTG deal, that perfect storm of such an influential figure (be that good or bad is up to the individual to decide), coupled with a meme-frenzy market, caused some people to become overnight millionaires.

Let’s look at how Unusual Whales caught the movement early and how social media propelled DWAC to never before seen heights.

Unusual SPAC Activity

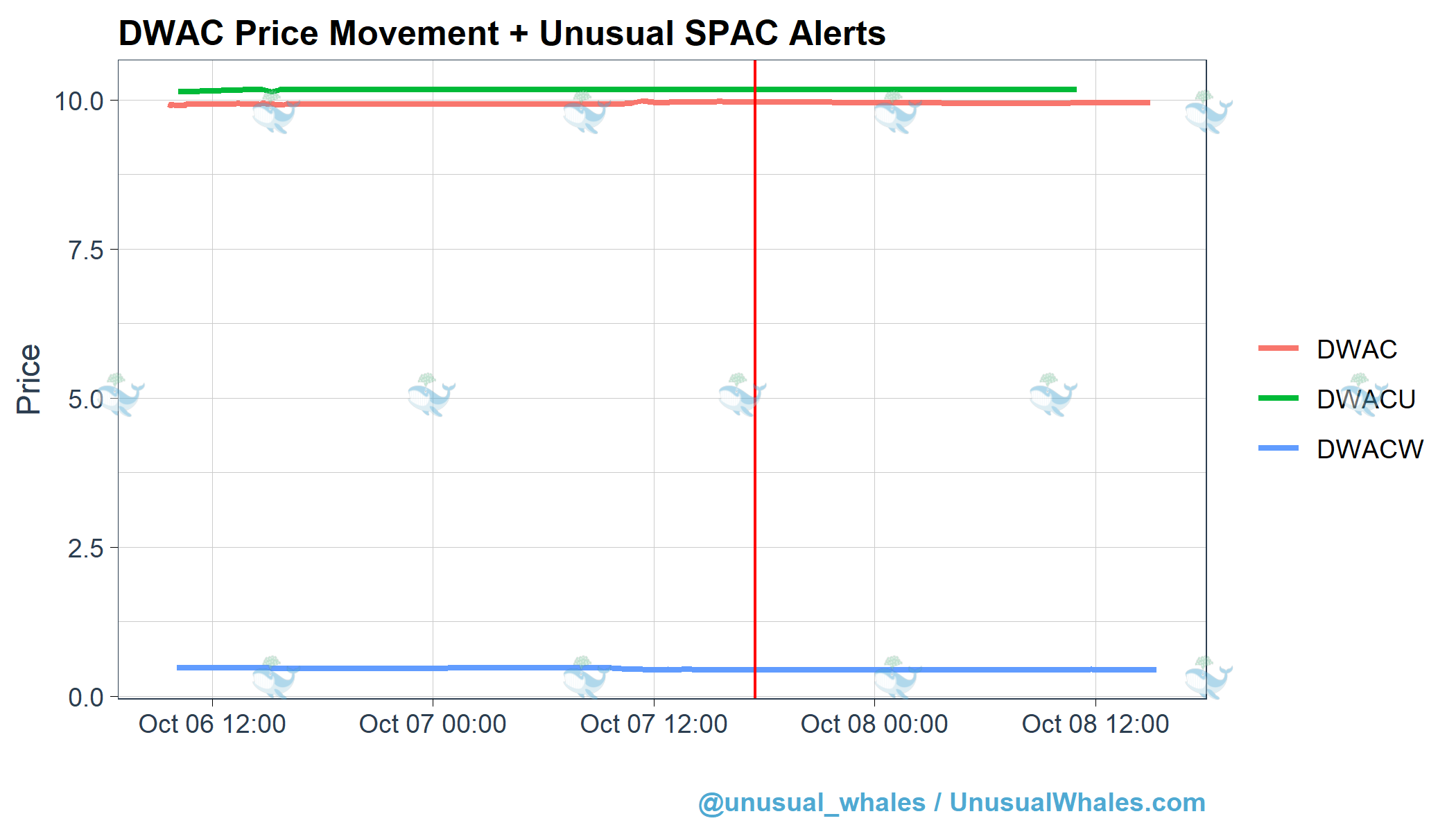

Our free SPAC alerts caught several waves of unusual movement prior to DWAC’s peak of $175. The first pinged on October 7th as daily volume picked up 574% higher than normal, but no immediate change in asset prices.

The alert service also caught unusual movement again on October 20th, the day of the announcement. This volume was 733% higher than normal.

Either of these unusual volume spikes could have been institutions getting the slip of information early, or rumors of DWAC CEO Patrick Orlando purchasing shares before the announcement, though the information regarding the purchase is to be debated and fact-checked.

Despite the unusual alerts, share prices remained stagnant until Thursday the 21st.

Trump Pump

DWAC Tweets

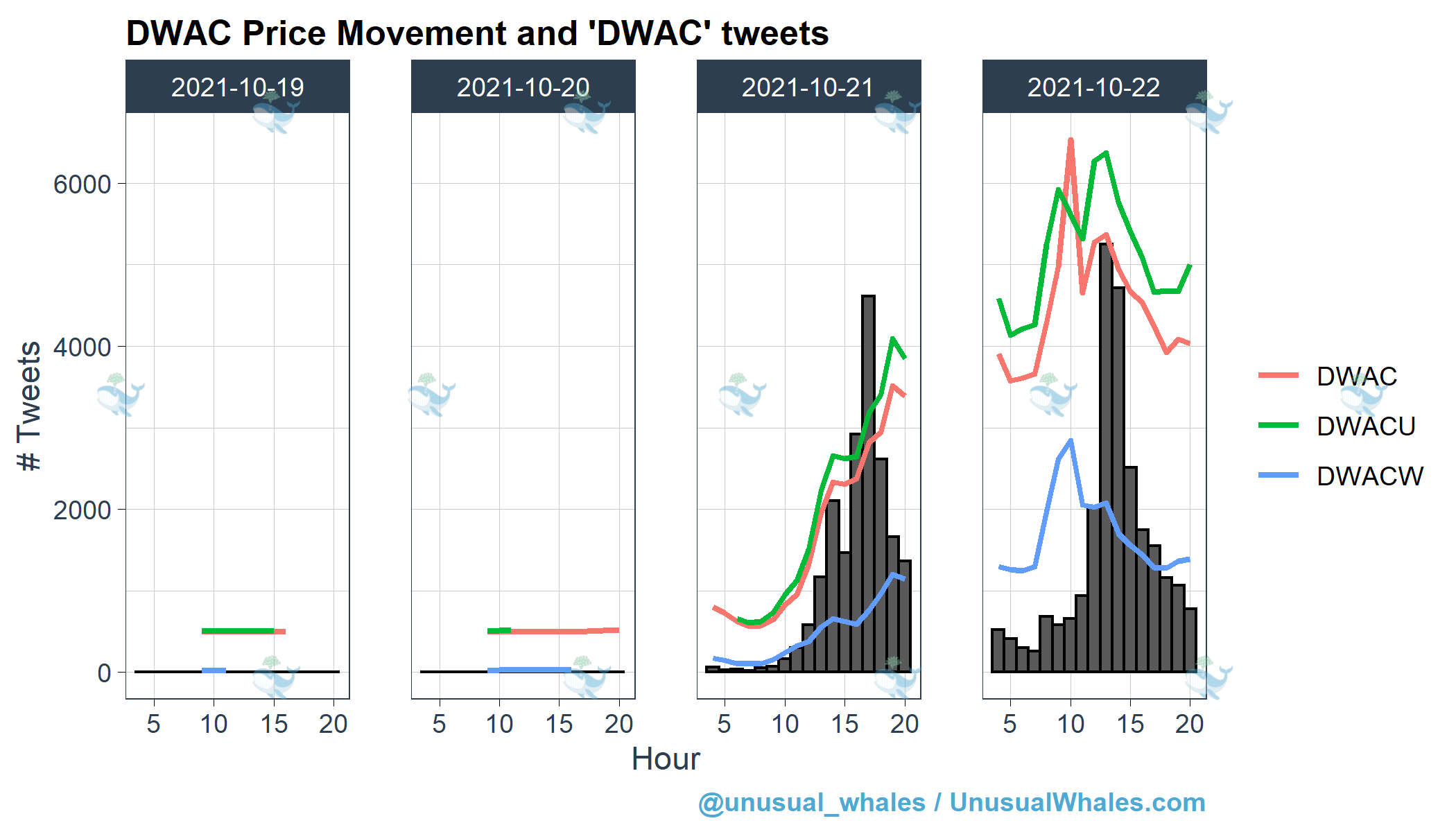

News first broke of the DWAC x TMTG deal on the evening of Wednesday October 20, 2021. We saw the price of all DWAC assets jump slightly in pre-market on the 21st and then explode at market open. Social media played a very crucial part in spreading the information quickly, and allowed for the news to break to millions of retail traders at the same time, which helped propel share prices.

The chart below shows the number of tweets mentioning “DWAC” relative to DWAC price movement during pre-market, market and after hour trading periods. On the 21st, we observed a strong correlation between the number of “DWAC” tweets per hour and the hourly prices of DWAC/DWACU/DWACW. A weaker correlation was observed on the 22nd.

Trump Tweets

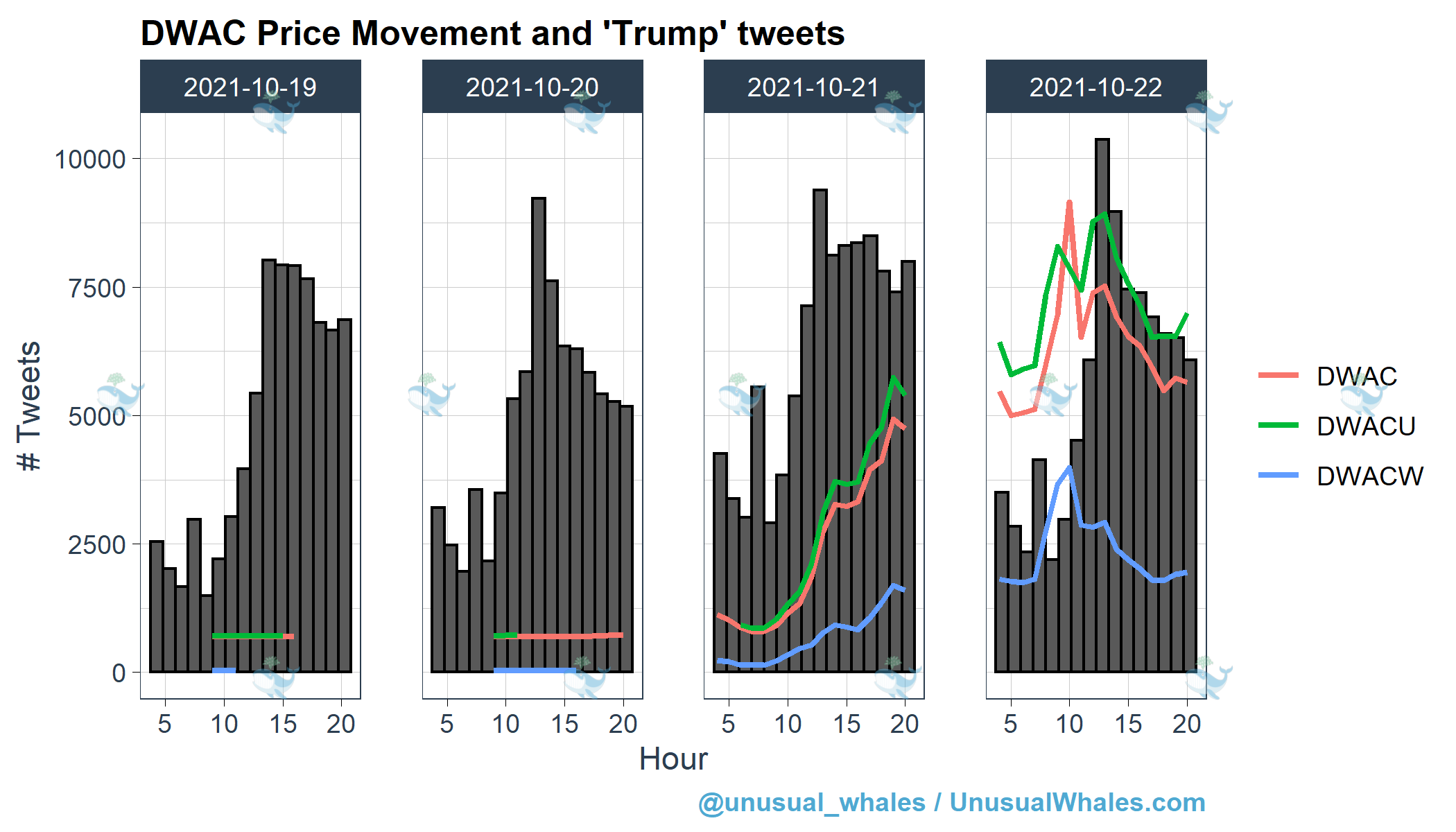

The chart below shows the number of tweets mentioning “Trump” relative to DWAC price movement during pre-market, market and after hour trading periods. We see that mentions of Trump were up during the day on the 20th and then trailed off after hours. It’s important to note that none of the tweets during this period mentioned “Trump” + “SPAC” or “Trump” + “DWAC” yet. On the 21st, Trump tweets were consistent and had high volume as DWAC assets ramped up in price. There was a strong correlation between “Trump” tweets, “Trump” + “SPAC”, and “Trump” + “DWAC” tweets and the price of DWAC assets throughout the trading day. We observed more “Trump” tweets mentioning “SPAC” on the 21st with “DWAC” name recognition and use coming into play more on the 22nd. Like “DWAC” tweets, correlations between price and “Trump” tweets were not as strong on the 22nd.

The relationship between social media and stock price, especially for assets tied to the powerful influencers, may help retail investors identify opportunities for massive gains in the future.

Putting This into Perspective

The below tweets showcase some of the astronomical gains that came with the DWAC announcement, with warrants reaching a gain of 2700% on October 21st, and as high as 15744% the 21st with some investors capturing massive returns.

SPACs have been a vehicle to bring ideas to the public market. They’ve been extremely hot among retail investors, but that’s not to say there aren’t risks. Mix in the greatest influencer of all time, hype built on social media and you get what just occurred with DWAC. Although we only looked at Twitter, we expect similar volume and interest in DWAC on other platforms like Reddit and Facebook. It’s important to remember that someone always knows, as evidenced by the unusual SPAC alerts fired right before explosive interest and price movement in DWAC. We hope you follow along at Unusual Whales!

This was post done in collaboration with @falcon_fintwit. If you have suggestions for further research, or if you have any questions about methods, feel free to DM!